Neurology is one of the most in-demand medical specialties in healthcare. The need for neurologists, both general and subspecialty, is spiking as the population continues to age, creating a misalignment between supply and demand of providers. And the gap is sure to grow, with the Bureau of Health Workforce projecting that neurologist demand will have increased by 16% increase from 2013 to 2025 while the supply of providers will increase by only 11%.

Neurology residency positions have a consistent match rate of over 95%, indicating neurology is a desired specialty among medical students and has a strong pipeline. Further, many neurology providers opt for additional, specialized training. As of 2024, there are over a dozen accredited neurology fellowships available to residents, with over 90% of neurology residents pursuing subspecialized training. This increase in subspecialization has impacted timely patient access to general neurology care in many markets across the country.

To help neurology leadership and compensation professionals understand the market dynamics and offer recruitment packages that are competitive yet sustainable, we have summarized data trends and market observations pertaining to the neurology subspecialty compensation environment.

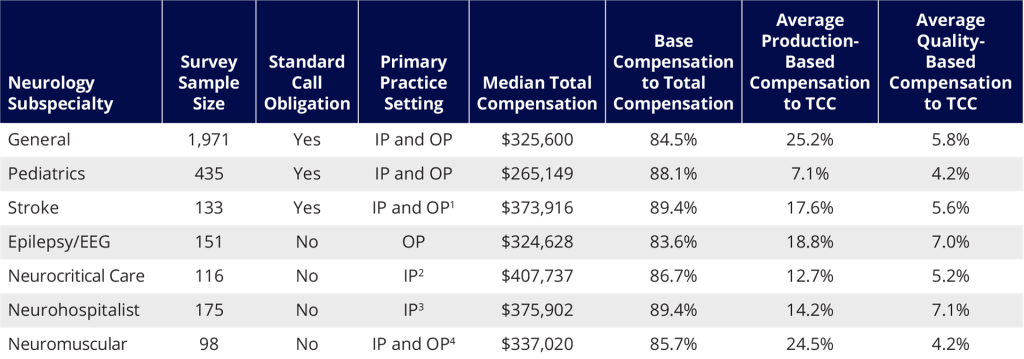

Given the fierce competition for recruitment and retention of neurology providers, organizations need to understand the nuances of neurology subspecialty areas with respect to compensation plan design and market benchmarks. Data from the ECG’s 2024 Physician and APP Compensation Survey is summarized in the table below.

Neurology Characteristics by Subspecialty

The characteristics detailed in this table often influence how compensation packages are designed and how various subspecialties are differentiated within the plan, including how their clinical effort is defined and tracked and how their compensation risk profiles vary.

Here are some notable insights and considerations from the data presented above:

- Sample sizes vary greatly, and more specialized areas should be closely examined across surveys and even across similar subspecialties.

- Inpatient subspecialties have a greater proportion of dollars in base compensation that are tied to measures of time, such as shifts or weeks of service. Since they are primarily coverage-driven, they may not have the same volume potential as outpatient specialties; WRVU incentives can still be applied, albeit with less weighting and not as a primary driver of pay.

- Many of the neurology subspecialties have both inpatient and outpatient coverage potential. In hybrid practice environments, it is important to understand the impact that service area can have on productivity potential and coverage requirements (e.g., total hours). Many groups struggle to translate CFTE expectations within these hybrid groups to ensure that parity across clinical effort is roughly maintained within the group.

- Subspecialties with higher coverage and call coverage requirements tend to have higher median compensation. Individuals in certain subspecialties may be a sole provider of the subspecialty care at their organization; this additional burden of coverage and service can further impact total cash compensation levels.

- Finally, we are beginning to see some groups take proactive measures to ensure their increasingly specialist-heavy cohort collectively see enough general visits to improve patient access measures. This can involve stricter rules around clinic template utilization and excess dollars for access clinics. We have even seen some groups entertain a premium for general neurologists, signaling a departure from the standard subspecialty training premiums and spotlighting how hard it can be for some groups to incentivize general care.

These statistics and observations are provided for your reference, but any compensation plan should consider crucial elements such as clear definitions for expected and excess care per CFTE, team-based care incentives, case mix and payer mix changes, individual productivity potential, and local market supply and demand considerations. While there is no quick fix for closing the provider supply-demand gap, understanding the nuances of each neurology subspecialty can help physician groups and system recruiters as they pursue the available provider pool.

In a follow-up to this piece, we’ll take a deep dive into the scope of several neurology subspecialties through the lens of our custom surveys to highlight key considerations in compensation planning and establishing fair market value.

¹ https://www.ahajournals.org/doi/full/10.1161/01.str.0000099140.79571.88

² https://link.springer.com/article/10.1007/s12028-018-0601-1

³ https://www.neurology.org/doi/10.1212/WNL.0b013e3181c918a0