Health plan network discounts have become the number one financial metric that insurance consumers—namely self-funded employers and brokers—rely on to determine the lowest-cost option when selecting their carrier of choice. Although reporting your health plan’s network discounts is voluntary, it is often a necessity if you want your plan to even be considered during a request for proposal process—and the results of a carrier’s reported discounts can have major implications on the ability to grow and retain business.

Discount reports.¹ such as those supported by the Uniform Discount and Data Specification (UDS) process, tend to consistently show significantly favorable results for national carriers such as Aetna, Anthem, and UnitedHealthcare. While brand value, market share, and network size can allow these major health plans to attain lower payment rates with providers, they also employ dedicated teams with the sole focus of optimizing (i.e., strategically selecting) their claims data for these submissions and subsequent reports.

Regional health plans, despite the advantages of national carriers, have opportunities to compete—and they must in order to grow or maintain market share. Smaller health plans can enhance and accurately report their network discounts by adopting advanced data analysis and optimization strategies. This could significantly improve their competitive positioning and mitigate the dominance of national carriers by showcasing their own cost-efficiency and value to consumers.

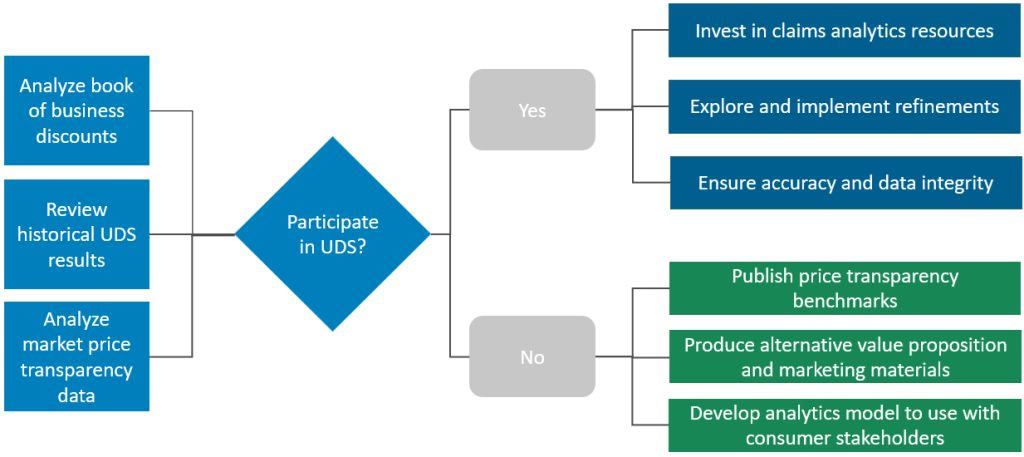

Below, we outline the complexities associated with UDS submission and highlight the strategic considerations health plans need to make to optimize their participation and accurately represent their value proposition. We also discuss the use of price transparency data to counter the UDS results (or supplant them entirely) and the additional benefits of utilizing this information.

The UDS Process Overview

UDS has become a standard data submission process in the healthcare industry to analyze provider network discounts. Participating health plans submit most—but not all—of their claims data set to insurance brokerage firms. These submissions are organized by service categories of inpatient, outpatient, and professional, specifically including charges, negotiated allowed amounts, and region.

This data allows brokers to report on network discounts by service category and region by payer, compared to all other health plans in the market that also participated in the submission. Its purpose is to provide a standardized set of metrics for stakeholders to evaluate the economic benefits of different health plans. These reports are frequently used by brokers to guide self-funded employers through the health plan selection process. Health plans that do not participate in the final report outputs are often neglected during these conversations.

While the discount metrics are easy to understand, the UDS process’s simplicity can be deceptive, glossing over the complexities of healthcare reimbursement and potentially misleading consumers. The submission is not properly regulated, and the lack of penalties for inaccurate or misrepresentative data submissions leaves room for interpretation and potential bias, particularly as the major insurance carriers largely influence the specifications. The skewed participation further complicates the landscape, as local health plan network pricing often seems unfavorable when it may very well not be.

By thinking proactively about a long-term UDS participation strategy and intentionally investing in increased analytical sophistication, health plans can optimize their submission, better represent their value proposition, and position themselves to produce new metrics that augment UDS data.

Strategic Considerations for UDS Participation

A thoughtful and strategic approach is essential for health plans considering participation in UDS. While not participating may not be an option for many plans, participating and reporting unfavorable results may be even more detrimental to a plan’s membership growth and retention numbers.

To decide whether to participate, perform a thorough evaluation of your utilization data and contracted rates to assess how your current rates compare to market competitors. Additionally, evaluate rate and reimbursement amounts from different angles to test the most accurate and transparent method of measuring market discounts, with the possibility of these measurements returning a more favorable result than UDS reports.

Ultimately, your plan must balance several factors when weighing the decision to participate in UDS:

- Long-Term Participation. Has your health plan delineated its long-term strategy regarding participation in subsequent data submissions? If so, what factors will influence your continued engagement?

- Engagement with Benefits Consulting Firms. Which benefit consulting entities is your health plan considering for data submission, and what criteria guide your selection process?

- Exploration of Additional Exclusions and Adjustments. Is there a specific exclusion or adjustment your health plan wishes to investigate to refine its data optimization strategy? How accurately do these adjustments represent the discounts your health plan has negotiated in the market?

- Data Integrity and Representativeness. How does your health plan ensure that, while adjusting your data for submission, you maintain the integrity and representativeness of the data to accurately reflect performance and the value proposition?

- Regulatory and Compliance Considerations. Are there any regulatory or compliance implications associated with your proposed data submission strategy that you should be aware of?

- Alignment with Price Transparency. Does price transparency data analysis align with results from previous UDS reports? Are the results more or less favorable for your health plan?

- Alternative Metrics and Messaging. Using publicly published price transparency rates and your client’s group utilization, would it be more advantageous to stop participating in the UDS submission and instead share the results of price transparency?

- Comprehensive Value Proposition. In addition to quantitative measurements of network pricing, does your messaging and communication capture your health plan’s entire value proposition?

UDS Process Participation Decision Tree and Other Options

Long-Term Strategic Option: Superseding UDS with Price Transparency

With the availability of both hospital and payer price transparency data, health plans and other market stakeholders now have the ability to measure and compare network pricing among market participants. The price transparency files contain actual negotiated rate information necessary to determine the actual per unit costs for facility and professional sites of service. The publicly available price transparency data has the potential of being more accurate, timely, and transparent than UDS.

Moreover, health plans can apply price transparency to group utilization data to calculate the group’s service-mix-specific network costs. This can enable more accurate representations of a group’s care delivery costs between market payers. Additionally, developing a model to analyze price transparency data will inherently include group-specific utilization information that can enable more granular insights such as pricing differences by health system, region, and even service category—which can be highly valuable in growth strategies that target specific groups and their stated priorities.

Transforming Challenges into Opportunities

In conclusion, the UDS process, while a historical and widely used benchmark for evaluating health plan network discounts, presents both challenges and opportunities for health plans. National carriers have used their scale and dedicated analytical teams to optimize their submissions, often overshadowing regional players. However, the investment in advanced data analysis and optimization strategies offers regional health plans a viable path to improve their competitive positioning and accurately report their network discounts. Strategic considerations—including long-term participation, refinements to data submissions, and an understanding of price transparency—are crucial for health plans to accurately represent their true network value proposition.

By embracing these strategies, health plans can enhance transparency, ensure data integrity, and better communicate their comprehensive value proposition to stakeholders, potentially reshaping the competitive landscape in their favor.

¹Reports are produced by health insurance brokerage firms by aggregating discount data submitted by participating insurance carriers in a given market.

Editor: Matt Maslin