Against the backdrop of an ever-evolving and consolidating healthcare environment, the decision to preserve independence or pursue strategic alliances is taking center stage for a variety of hospitals and physician groups. Autonomy remains closely guarded, worn as a badge of honor by numerous hospitals and providers. Yet while some organizations possess the infrastructure, resources, and market conditions to remain independent, others are finding autonomy increasingly difficult, if not impossible, to sustain. The question being asked by these organizations is: How long can we maintain our independence?

Maintaining independence is one thing; clinging to it is entirely another. We find that most (but not all) provider partnerships are born out of mounting operational and financial distresses for a partner-seeking organization. Frequently, independent hospitals or physician groups choose to remain independent for too long, allowing market and economic forces to erode their long-term viability. It’s an approach that extends local autonomy but lessens or eliminates partnership opportunities over time. Eventually, “best fit” partners will have already committed to other providers or won’t be interested in a rescue mission.

Independent hospitals and physician groups that court partnerships before becoming overwhelmed by financial and operational challenges do so from a position of greater strength, which broadens their partnership appeal and options. Proactively seeking affiliation opportunities from a strong position frequently improves negotiating leverage related to clinical programs and services, community goals, capital, and facilities, among other key objectives.

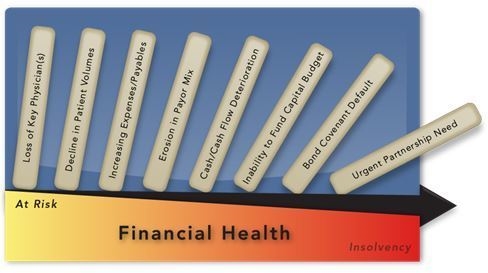

So why do hospitals and physicians seek affiliations? Rarely is it a result of a single event or performance against a handful of indicators. More commonly, a combination of forces and market factors make an affiliation increasingly necessary. See the figure below.

Thus, the role of the board and senior leadership is to identify “red flags” early on in order to take steps toward performance improvement and/or position the organization for an affiliation while it still has significant value.

- Financial red flags:

- Flat or declining net patient revenue

- Increasing bad-debt expense (greater than 10% increase from prior period)

- Weak operating cash flow margin (less than 6%) and downward trend

- Depreciation outpacing capital expenditures (2 consecutive years)

- Low days cash on hand (less than 90 days) and downward trend

- Operational red flags:

- Year-over-year decline in inpatient/outpatient volumes

- Decrease in market share

- FTEs per adjusted patient day exceeding regional averages

- Compliance or accreditation problems

- Loss or realignment of key physicians

The reality is that fewer organizations can stand alone in the new healthcare era, and some form of affiliation is or will be required for the majority of healthcare providers. Organizations that ignore this fact or cling to independence too long run the risk of ruin. Thus, providers need to ask themselves how long they should remain independent, not how long they can.