Organizations that applied for the CMS Bundled Payments for Care Improvement (BPCI) Advanced model are eagerly awaiting data from CMS. Expected in May 2018, this data will include historical claims and target prices (TPs) for each of the 32 clinical episodes that organizations previously selected for potential participation. BPCI Advanced offers organizations an opportunity to gain additional experience in a total-cost-of-care model with a program that has demonstrated success. A thorough assessment of historical claims data and comparison of historical payments to TPs will be one key to understanding potential opportunities and risks for each of the 32 clinical episodes. Once organizations complete a performance assessment, they can select the episodes for which they project the greatest success. The new model is set to begin October 1.

Read the overview on Building your BPCI Advanced Program.

Historical Claims Data

In April, CMS released a sample layout of the claims files that will be distributed to applicants. The data will be separated into seven key claims types, which are listed below. The claims data includes all baseline utilization across an initial “anchor” admission and the post–acute care 90-day period, accounting for all services within and outside the organization. Historically, the post–acute care network utilization and details have not been readily available to an organization.

Expected Claim Files Provided by CMS during May Data Release

- Inpatient services

- Outpatient services

- Physician/supplier Part B claims (professional services)

- Home healthcare

- Skilled nursing facility (SNF) services

- Hospice services

- Durable medical equipment (DME)

The claims data provided by CMS will be valuable; review and analysis of this information will be the key to understanding the organization’s opportunity for program participation and success. The organization will have access to data that spans the care continuum and provides an accounting of the spend and utilization throughout the duration of the 90-day post–acute care episode. This may be the first time an organization has access to claims data that encompasses the entirety of the patient’s episode.

Data analysis may require a certain level of technical literacy, that is, an understanding of CMS claims data, the ability to manage large of amounts of information, and a strategic approach to identifying high- and low-performing service lines and settings of care. For example, analysis of the claims may highlight that the patient’s acute care stay for a certain procedure is low cost; however, the same patient’s SNF stay may be driving up the total 90-day episode cost. The claims data allows an organization to review, analyze, and understand the full picture of CMS’s cost (also known as episode spend).

Target Prices

In addition to releasing the historical claims files, CMS will distribute TPs for each clinical episode. The TP is composed of the benchmark price less a CMS discount.

An organization’s benchmark price is a blend of three components:

- Standardized baseline spending, based on an organization’s historical efficiency measure that has been risk adjusted and peer standardized

- Patient case mix, which adjusts for the severity of an organization’s patient case mix

- Peer-adjusted trend factor, which adjusts for any persistent differences in spending across peer groups

CMS will determine severity from a combination of patient characteristics, including hierarchical condition categories, recent resource use, demographics, long-term institutionalized, MS‑DRGs/APCs, and episode category-specific adjustments. Peer groups will be determined by geographical and hospital characteristics, including classifications such as academic medical center, urban/rural, safety net hospital, census division, and bed size. CMS has not released the methodologies for determining the exact benchmark price. Both the specific hospital/peer-adjusted trend factor blend and the peer group definition remain unknown.

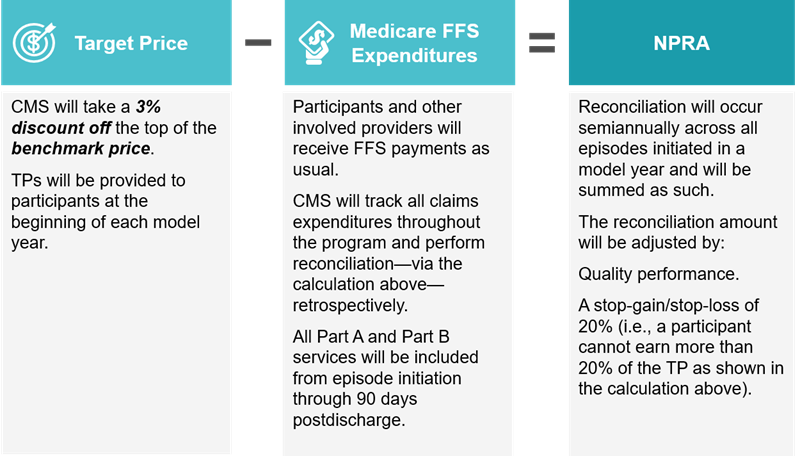

CMS will take a 3% discount off the top of the benchmark price. The resulting amount becomes the organization’s TP. The TP will be compared to the organization’s clinical episode spending (CMS’s cost/claims spend) to calculate the net payment reconciliation amount (NPRA) or the positive/negative amount participants receive/give back to CMS.

We anticipate that calculations of the TP will not be as clear as in previous bundled payment programs, such as BPCI or CJR. As a result, TPs will be harder to project in future model years. At the same time, the preliminary TPs released by CMS will be crucial in identifying potential opportunities, particularly for the first two program years of the model.

Performance Assessment

Identification of high-performing service lines and/or episodes indicates an opportunity for success in the BPCI Advanced program. The following steps should be taken as part of the performance assessment:

Step One: Preliminary Review of All Clinical Episodes

As part of step one, the organization needs to determine that a potential episode has sufficient volume. Once this is confirmed, key questions need to be asked to further analyze the potential opportunities. Sufficient volume is relative to the organization itself and will differ across entities depending on market characteristics, provider size (e.g., beds), and strategic direction.

Financial Opportunity: How does the organization’s episode cost compare to the TP, and will there be a savings opportunity?

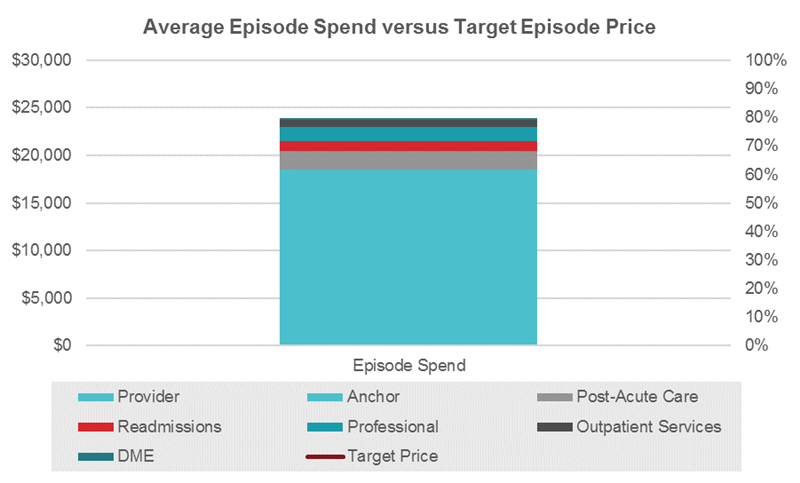

In the example below, the data analysis shows the average episode spend by payment source. On average, the total episode spend exceeds the TP. The organization has an opportunity for improvement; because the spend is above the TP, the organization could try to reduce utilization to achieve savings. On the other hand, if the organization was already performing below the TP, it would be even better positioned to achieve savings with that episode.

Outcomes: How do the organization’s readmissions and/or post–acute care utilization rates drive cost in the episode?

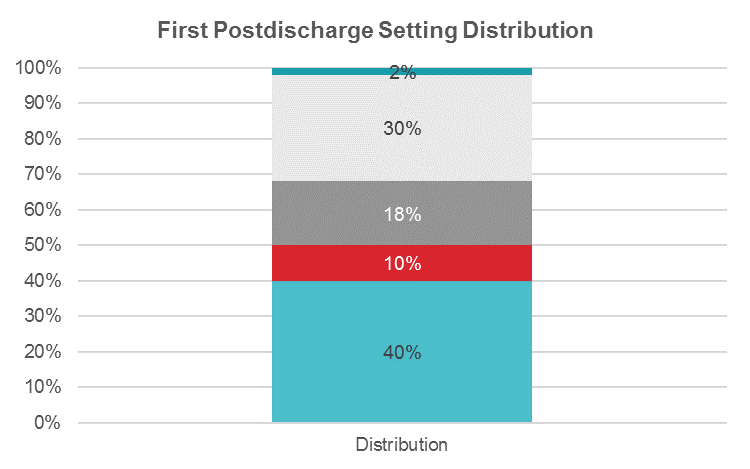

In the example below, the data analysis specifies the average first postdischarge setting distribution for a specific episode. On average, patients are being discharged to an inpatient rehabilitation facility (IRF) 30% of the time. This is a high-cost setting, which is likely driving up the average episode cost. The organization can focus on shifting some IRF discharges to a lower-acuity setting, such as a SNF.

Step Two: Selection of Episodes

Once the list is narrowed down from step one, the following more detailed questions should be reviewed and answered for the remaining episodes under consideration:

Care Standardization Opportunity: Are there service lines that may benefit from additional efforts to either develop care pathways or further enhance existing pathways?

The organization should work with its physicians, providers, and program administrators to determine the opportunity for care standardization. Streamlining care processes such as patient check-ins, education, ambulation/PT, and discharge may offer a “quick win” to achieve savings on the inpatient episode cost. Other care standardization activities include care process mapping, clinical pathway development, and order set review.

Physician Alignment Opportunity: Are there certain service lines that would benefit from enhanced physician alignment through an initiative focused on bundled payment gainsharing?

There is a strong opportunity for coordination and alignment through gainsharing with physicians, particularly with those who are independent. Organizations should include and engage physicians when building the bundled payment program. Being inclusive will allow for strong buy-in from the physicians and generate additional support for reducing inefficiencies and achieving cost savings.

Next Steps

After CMS releases historical claims and TPs in May, organizations should immediately begin to analyze the data with a goal of developing a list of suggested episodes by the end of June (step one). Once that list is developed, organizations can begin to prioritize efforts that lead to successful implementation of the model (step two). Organizations must submit their participation agreements and participant profiles (clinical episode selection) to CMS by August 1 and will continue to receive claims data monthly. However, competencies built now can be utilized during program implementation.