In the final Medicare Physician Fee Schedule rule published in the Federal Register on November 23, 2018, CMS outlined its effort to reduce the documentation burden for evaluation and management (E&M) services. As a result, the care management benefits allow providers more time to see and improve the lives of their patients. However, the policy collapses the reimbursement rate for common services billed by primary care physicians, which has implications for managed care payer strategies. This transition has begun in 2019 with the streamlining of documentation requirements for the proposed collapsed payment levels 2 through 4. The staggered implementation timeline gives health systems and physicians time to adopt the new documentation requirements and update processes accordingly to accommodate the code changes. Given that these changes are expected to result in Medicare rate increases of nearly 15%, as well as implications for commercial payer strategies, it will be important for health systems to use this transition period to evaluate the financial impact and plan accordingly prior to the full rollout in 2021.

2019 Documentation Changes

The overall change collapses the time and resources for new and established patient visits for those with an acuity level of 2 through 4. The level 5 code will remain to address complex care.

The documentation changes are intended to lessen the physician burden of billing for E&M services. This is a significant change given that documentation and billing processes for these services had been in place for 20 years. Accordingly, providers are only required to use what are now the standard coding guidelines for a level 2 to support all three visit levels of care. Additional work flow planning and documentation may be necessary to support additional time, medical decision-making, and complexity. Though CMS’s overall intent for the new codes is projected to be revenue neutral, this simplified documentation approach is expected to save millions in reduced administrative costs in the form of physician hours.1 For example, the streamlined requirements now in place include the following changes and considerations:

- Eliminates medical necessity documentation for home visits

- Allows for relevant information updates only, if applicable, when seeing established patients

- Removes the need for duplicative history and physical exams for established patients

- Allows ancillary staff to document chief complaints for an established patient

- Requires that the physician need only provide an acknowledgment of documentation made by ancillary staff, which saves time

2021 Reimbursement Implications

Providers have two years to adjust before the new collapsed payment will be implemented. Specifically, this collapsed rate means that levels 2 through 4 will have the same WRVU and base rate. As a result, the WRVUs and base rates will increase for level 2 and 3 codes but decrease for level 4 codes. The collapsed payment is based on a national weighted average for the past five years; historically, codes for levels 3 and 4 have been the most predominantly used—at 75% and 89%, respectively—for new and established patients.2 One factor contributing to the collapsed policy is a noted inconsistency in utilization for acuity levels 4 and higher. However, the rate disparity may cause providers to reevaluate the relevancy and documentation of level 4 codes to support case complexity and time spent with patients.

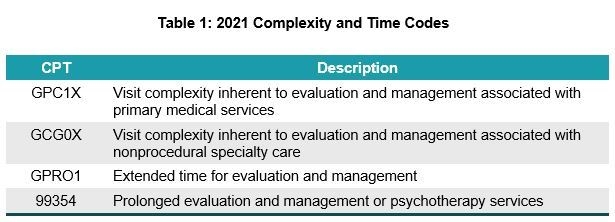

CMS addressed concerns about the reduced base rates and recognized the need to account for inherent complexity, specifically for primary care and nonprocedural specialists. As such, new add-on codes GPC1X and GCG0X will be available for eligible providers. Qualification for this add-on means a $13 increase in reimbursement for levels 2 through 4. CMS also acknowledges that time spent with the patient remains another critical factor for levels 2 through 5. Since existing extended time codes require a threshold of 60 minutes, a new code, GPRO1, will be established for prolonged evaluation associated with levels 2 through 4 to support the cases when a provider visit goes beyond the usual 30 minutes. Extended time for level 5 patients will continue to be recognized and should be reported using the existing code 99354. Table 1 summarizes the codes available for potential add-on revenue.

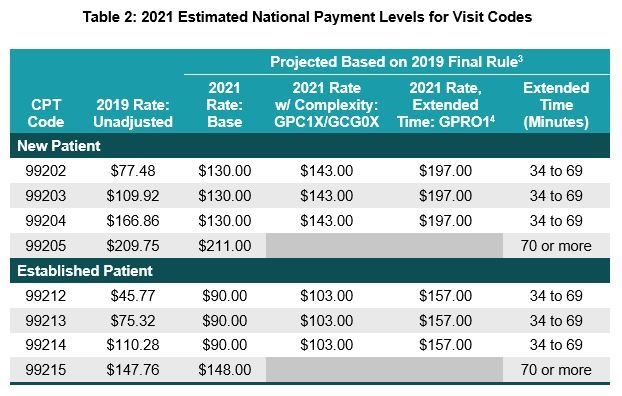

Table 2 highlights the reimbursement levels and criteria for the collapsed visit codes.

Impact Analysis: Primary Care

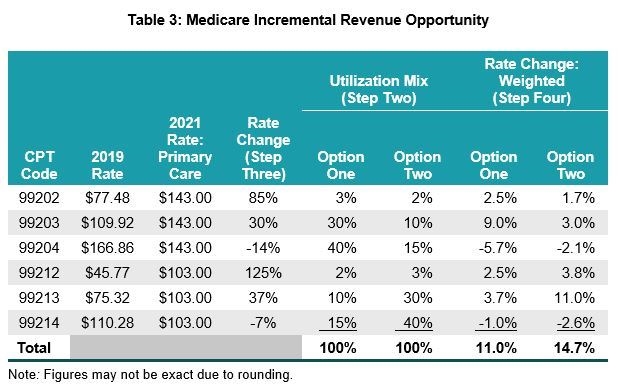

A significant portion of revenue for a primary care physician is reflected in office and outpatient visits. As such, an analysis of the Medicare utilization for these services will help quantify the overall incremental revenue that can be realized by adopting the new documentation and coding guidelines.

Step One: Quantify the annual billed volume for level 2 through 4 codes.

Step Two: Understand the utilization mix for each visit level.

- What percentage of the business represents higher-complexity codes?

- Is the mix weighted more toward new or established visits?

Step Three: Compare the current unadjusted CMS RBRVS rate to the impact of the add-on code for primary care, GPC1X, to calculate the rate change.

Step Four: Multiply the rate change (from step three) by the utilization mix percentages (from step two).

Table 3 is an illustration of the impact analysis of two options: Option one reflects a provider whose utilization favors new patients, whereas option two shows the impact of a mix more heavily weighted toward established patient visits. The findings suggest that the losses realized from the collapsed level 4 visit reimbursement in aggregate should be favorably offset by increases in lower-acuity visits. As such, the potential overall incremental revenue opportunity for primary care physicians, excluding extended time factors, is significant. Projected Medicare increases in aggregate should average between 11% and 15%, based on the utilization mix of the type of office visits for the practice.

Commercial Reimbursement Considerations

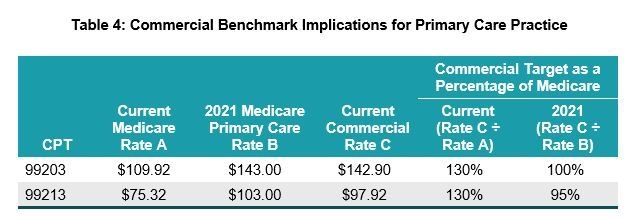

The impact on a physician’s commercial payers is less certain, since it will depend on how insurers adapt their systems to react to these code changes. That said, from a managed care strategy perspective, a group may need to adjust negotiation target reimbursement levels to ensure its overall payer portfolio remains consistent or becomes even more favorable. For example, per the benchmark implications in table 4, if the provider’s strategic goal has been for a level 3 code to be priced at a commercial reimbursement level of 130% relative to Medicare, the impact of the new collapsed rates for level 3 will result in this differential being equal to or below this established target.

To prepare for these changes, it is recommended that providers consider inventorying their commercial arrangements to evaluate proposed changes and the implication to established strategic priorities. A few focus areas should include the following:

- Identify fee schedule source for each commercial payer.

- Consider adding fixed carve-out rates during current renewal discussions for level 3 and 4 codes.

- Prioritize discussions with payers where fee schedules are based on prevailing CMS RBRVS factors to amend the applicable fee schedule to reflect a fixed year (e.g., 2019).

- Analyze baseline utilization trends compared to prevailing Medicare rates.

- Discuss options with commercial plans for incentive payment arrangements to manage higher-acuity visits.

- Provide education tools to the care management team to clarify documentation requirements to support the appropriate billing for higher acuity levels and extended time spent with patients.

Footnotes

1. MLN Call Transcript, “Physician Fee Schedule Final Rule: Understanding 3 Key Topics Call,” November 19, 2018.

2. CMS 2019 Final Rule.

3. The provider’s realization rate for each level and add-on code will be geographically adjusted.

4. Additional time for a level 5 will use the existing code 99354.