The past decade has produced rapid change for independent physician groups. The complex variables shaping healthcare’s environment also impact the decision-making framework for independent physician groups contemplating their long-term partnership and affiliation options. Regardless of size, scale, specialty, or location, these groups face challenges from all vantage points: operational, technological, regulatory, and clinical. As the velocity of industry-wide change accelerates and practitioners’ time stretches increasingly thin, independent physician groups have been challenged as they strive to deliver on their missions to provide the highest-quality patient care and service. As a result, physician groups increasingly desire and need to identify and align with strategic partners with the capital, infrastructure, and managerial expertise to overcome the obstacles facing provider organizations.

Finding the right strategic partner has become mission critical for many independent physician groups seeking to achieve their long-term goals and maintain market relevance within their geography. The questions of when, how, and with whom to partner are often daunting and fraught with unknowns. To navigate this uncertainty, one must understand the factors that have led to this current state, as well as how strategic partnerships and affiliations will continue to shape the physician group sector in the long term. A foundational knowledge of these considerations is essential in guiding any provider-based organization toward future success.

A Retrospective Primer on Physician Group Partnerships

Physician groups have evolved in both size and capabilities and today generate broad investment interests from a wider range of organizations than ever before. Small practices of a handful of local physicians, prevalent a generation ago, have been joined in the market by larger single- and multispecialty groups operated by highly professional management teams. The growing diversification in the size, scale, and specialization of the physician group sector has led to a paradigm shift in the type of investor interest, increasing the strategic alternatives for physician groups considering their long-term partnership and/or affiliation options.

The principal long-standing strategic option for independent physician groups has been to partner with a local and/or regional hospital/health system with which they likely had an existing relationship. Typically, the group members would ultimately become employed physicians. In the last 20 years, driving forces behind physician group partnerships with hospitals/health systems included:

- Challenges related to new physician recruitment.

- Ongoing changes in the local, regional, and/or national reimbursement landscapes.

- Increasing entrepreneurial business–related risks for physicians.

- Incentives and penalties for the adoption of electronic health record systems.

- Considerable surges in overhead requirements.

Likewise, hospitals and health systems viewed partnerships with market-area independent physician groups as opportunities to strengthen their continuum-of-care capabilities, grow their patient capture and volumes, enhance their overall competitive positions, and provide better care to the communities they served.

In contrast to this more traditional hospital/health system affiliation, a new partnership option for independent physician groups emerged in the 1990s in the form of the private equity industry. During this period, physician groups were sought after by private equity firms looking to make strategic investments with the intent to increase scale, add tangible business value, and realize a return upon their exit from the investment. The first major wave of private equity investment came in the dental sector with the development of management service organizations. These organizations contracted with individual dental groups to provide key services like back-office support, marketing capabilities, and contract negotiations. Physicians benefited by having more time to focus on patient care delivery and, under many arrangements, retained their clinical autonomy despite selling a controlling equity ownership stake of the practice. Iterating on the experiences and successes in the dental sector, private equity firms have progressively expanded their focus and investment efforts to include other specialties with high patient demand and strong, fundamental long-term growth prospects, such as dermatology, pain management, and ophthalmology. For context, in 2011, only one private equity firm was focused on the dermatology sector; as of January 2019, there were over 20 active private equity dermatology platforms managing and/or seeking new investments.

The Current State of the Physician Group M&A Market

As private equity investment has continued to rise, the market has shifted away from legacy investments by hospitals/health systems in physician groups. Amid an increasingly challenging operating environment, independent hospitals and health systems have to examine their long-term planning initiatives more closely. And when contemplating their capital investments, hospitals and health systems must consider headwinds that have driven unprofitable returns that disproportionately impact hospital-employed physician groups over their independent physician counterparts. MGMA DataDive 2018 Cost and Revenue data indicates that hospital-owned multispecialty physician groups lost an average of approximately $185,000 per employed physician. In the current state, only well-established hospitals/health systems with the requisite capital position, financial strength, and clinically integrated networks are truly able to pursue strategic partnerships and/or affiliations with independent physician groups (locally or regionally).

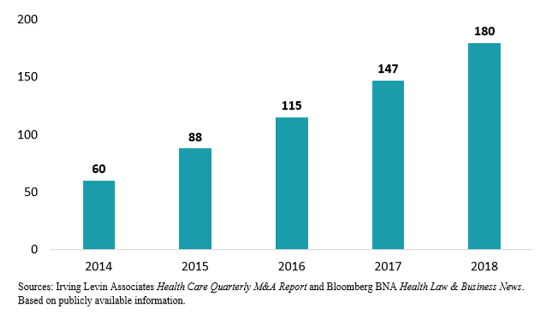

Despite these recent challenges facing partnerships among and between physician groups and hospitals/health systems, overall physician group partnership activity remains at an all-time high. This trend is fueled by continual capital injections into the sector from private equity firms of all shapes and sizes, as well as by continuous investment and acquisition activity being undertaken by both strategic acquirers/aggregators and vertically integrated healthcare providers, as shown in figure 1.

The private equity industry’s sustained interest in physician group investments is a by-product of its historical success in provider-based investments. Deployments of investment capital into the healthcare provider sector range from New York City–based KKR’s multibillion-dollar leveraged buyout of Envision Healthcare to middle- and lower-middle-market firms recapitalizing independent physician-owned practices to form platform investments in specialty sectors such as urology and gastroenterology. Factors driving private equity firms and strategic aggregators of physician groups include the following:

- Scalability

- Opportunities to realize near-term operating efficiencies

- Changes in consumer-driven patient preferences

- Highly fragmented local and/or regional markets

- Profitable ancillary services

- Increased market share capture opportunities

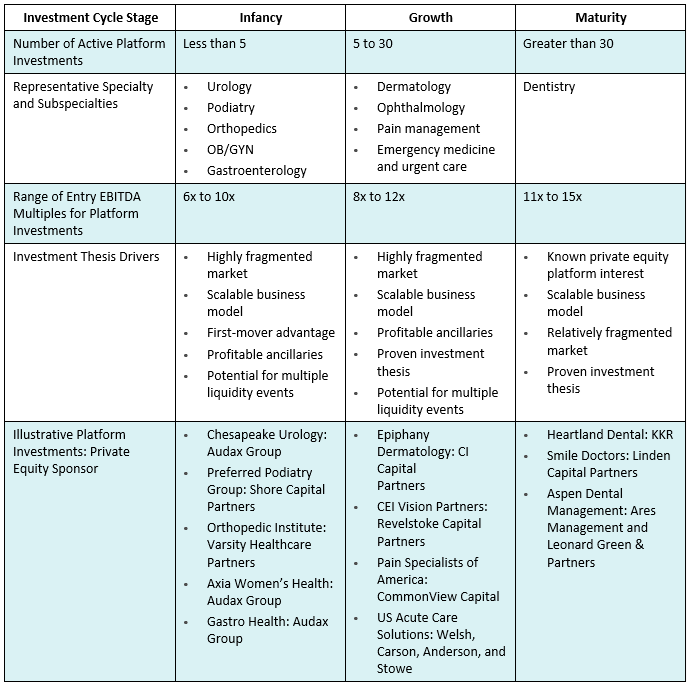

Specifically, the forces fueling private equity investment in physician groups have led to an array of firms seeking to capitalize on the sector. As physician groups seek to qualify strategic partnership alternatives in relation to the private equity community, it is imperative to have a keen understanding of these investments’ various stages of maturity, which are summarized at a high level in table 1.

Beyond the private equity investment community, physician groups need to also consider a relatively new buyer type that has entered the market: for-profit strategic aggregators. These companies are a differentiated option for physician groups, as they acquire independent practices that align with their initiatives across the care continuum, such as large multispecialty groups, primary care–focused practices, and urgent care centers. Strategic aggregators seek to offer the entire continuum of care within a specific market or geography, which can result in a more sustainable business model in an operating environment that is characterized by rapidly rising costs and shifts in reimbursement. Presently, strategic aggregators are building ambulatory surgery and urgent care centers to accelerate shifts in patient care (primarily toward outpatient care settings).

The merger announced between Optum (a division of UnitedHealthcare) and DaVita Medical Group in December 2017 is a strong demonstration of the growing presence of strategic aggregators. The impetus for this multibillion-dollar merger was the parties’ intent to offer the full continuum of care on a national scale. Optum’s data analytics and technology will augment and streamline the work of DaVita, which offers primary, specialty, in-home, urgent, and surgery care services. The combination is intended to improve care quality, cost, and patient satisfaction through integrated technologies and additional support for clinical services.

Another interesting example of how strategic aggregators are impacting the physician group sector is the recent announcement of Humana partnering with two large private equity firms, TPG Capital and Welsh, Carson, Anderson, and Stowe, to acquire a 40% share of Kindred Healthcare. The trio carved out Kindred’s home health, hospice, and community care businesses and renamed the company Kindred at Home as part of Humana’s strategy to expand its Medicare Advantage footprint. This transaction is only one of many examples of how payer organizations are increasingly moving out of their silos to vertically expand their service portfolios.

The Future State of the Physician Group M&A Market

Independent physician groups seeking to evaluate strategic options must critically examine their prospects. From a high-level perspective, the US economy is currently riding the second-longest bull run in history, leading many market observers to ask when and how this current upswing of economic expansion will modulate—key questions for all businesses to consider, regardless of industry, size, or scale. Some healthcare providers will undoubtedly be better positioned than others to weather a potential economic downturn.

More specifically, an economic downturn will be a catalyzing event that impacts a national hospital-health market composed of organizations that will be further challenged to sustain their missions. As described in ECG’s blog post 2019 M&A Outlook and Predictions for Independent Hospitals and Health Systems, the market is increasingly be-coming a bifurcated landscape of “haves” and “have nots” depending on strength of capital resources. Organizations that currently lack capital will face incremental operational strains that will be accelerated by a looming dip in the economy. Even entities with ample capital resources will be more hesitant to make investments in physician groups as the cost of borrowing rises, capital becomes constrained, and ultimately capital investment decisions are further scrutinized. Hospitals and health systems will vet their strategic investments more stringently, challenging what could be brought to the table by a partnership with a physician group.

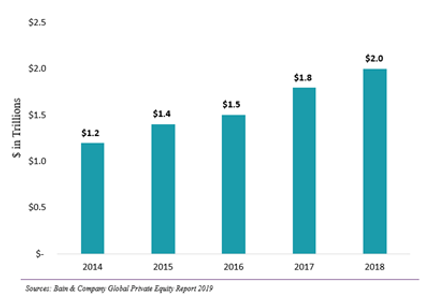

In contrast to an anticipated decrease in partnership activity among and between physician groups and hospitals/health systems, private equity firms and strategic aggregators are extremely well positioned to shift their physician group partnership and affiliation initiatives into the next gear. More specifically, in relation to private equity’s ongoing investment efforts within the sector, Reuters estimates that as of March 2019, firms across the US had as much as $1.2 trillion of investable funds earmarked for future healthcare-related initiatives.

How Will You Respond?

With no expected slowdown of the forces driving changes to the everyday practice of medicine, the market for physician group partnerships, affiliations, and strategic transactions will continue its rapid pace in 2019 and beyond. As more capital partners and strategic acquirers seek to participate in this trend of consolidation and growth, physician groups contemplating their strategic alternatives need to be increasingly diligent in partnership selection and timing. Providers are faced with critical economic and strategic decisions that will serve to anchor and, in many ways, dictate their long-term success. To ensure optimal outcomes for all parties involved, the ever-changing dynamics of the physician group transactions environment demand expertise and experience.