In our initial blog regarding the health systems of the future, we defined two key drivers for success: patient centricity and value transparency. Achieving these involves daunting transformations across multiple dimensions. So when should we be prepared to focus our efforts to support this transformation?

Though the two drivers noted above provide competitive advantages even in predominantly fee-for-service markets, they become critical in markets where the cost risk for care shifts to the provider network and even more so if the risk shifts to a single provider organization. A significant level of cost risk requires a health system to deliver care in a more efficient manner through a combination of population health management and cost reduction. To say this will be challenging for most systems is an understatement.

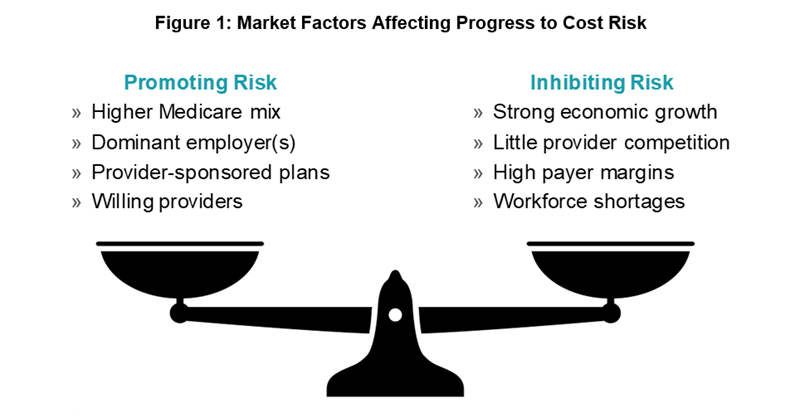

Although the majority of providers will face some level of cost risk through CMS-driven payment models (Medicare or Medicaid), the actual level of risk exposure in a given organization will depend upon a variety of factors. The evolution of risk-based payment models is not uniform; not all markets are evolving at the same rate, due to differing demographics, economic trajectories, competition, historical trends in employment patterns, and payer margins.

As illustrated in figure 1, the relative influences of these factors ultimately determine a market’s risk trajectory. For example, CMS reimbursement decisions and policies are less relevant in younger-trending markets such as Denver, Atlanta, and Nashville. In addition, markets seeing rapid economic growth and competition for a skilled workforce appear to be more resistant to the trend toward higher cost risk for providers.

Risk Promoters

Where a market has a dominant employer (10% or more of the local population or more than 20,000 lives—e.g., Boeing in Seattle) and employment rates are average to low, or the employer is industry dominant, the employer can typically focus some portion of its cost management efforts on benefit costs, the largest of which is invariably employee healthcare. Such an employer is likely to support and even drive a shift of cost risk toward the providers who serve its employees and even to the employees themselves.

In markets where provider organizations themselves sponsor consumer health plans, such as large areas of Wisconsin, cost burdens shift toward providers either directly, through initiatives focused on provider cost reduction driven by the captive plan, or at the enterprise level in the inherent hedge strategy that housing both provider and plan entities under a broader enterprise implies (i.e., a good year for the hospital may be a down year for the plan and vice versa). An incubator example of this, of course, is self-insured employee benefit plans sponsored by a health system, in which nearly every dollar saved on care is a direct benefit to the organization. The success of these models, however, is subject to the same forces as for any other employer in the market (see Risk Inhibitors below).

In a smaller number of markets, providers themselves are leading the charge to take on risk, hoping that other components of the health ecosystem will reward them for lowering costs by increasing their market share. This requires bold vision and strong leadership informed by indicators that benefits will be forthcoming (from payers or employers). Our view is that this strategy can work for some systems, but it must be carefully calibrated to the specifics of the market in order to avoid margin erosion.

Risk Inhibitors

Markets with burgeoning economic growth appear to be more resistant to provider risk-taking than those with mild to negative growth. This may be attributed in part to relative labor shortages in these markets; competing employers need healthy benefit packages to draw and retain workers and are often less receptive to narrow networks and other forms of cost controls that risk-bearing providers need in order to be successful. It is also likely due to an influx of younger-working-age populations who provide premium dollars at lower costs to payers.

The payers themselves are also less inclined to share risk in markets where they have healthy margins. Like any entrenched institutions, they experience organizational inertia regarding business changes when times are good, and their own processes are firmly ensconced in the fee-for-service business model. Reengineering not only business processes but IT systems and accounting models is a costly task with little apparent benefit when employers are willing to pay high premiums and providers are rewarded only marginally, if at all, for keeping costs down.

Finally, a market with little provider competition also has little impetus to change, when dominant or sole providers essentially dictate costs. Just as institutional inertia afflicts the payers, provider organizations will also need to feel some pain to be motivated to take on more cost risk. Though markets with little provider competition may still have significant exposure to CMS-driven reimbursement models, these are still largely voluntary, and reimbursement rates vary regionally such that the impact of exposure can be dramatically blunted. We believe that competition is going to be essential to drive markets in which truly future-state health systems will evolve.

Understanding Your Market Is Critical to Timing Your Transition

Each organization’s situation is different, but by considering the factors outlined above, you can arrive at a considered strategy to embark on a transformation to becoming the health system of the future. There are caveats to this paradigm, of course, but we have seen it borne out more often than not. And even markets with less competition will still be at risk for disruptive innovation that can take away high-margin business, as discussed in our whitepaper, “Transformational Drivers in the Health System of the Future.”

LEARN MORE ABOUT THE HEALTH SYSTEM OF THE FUTURE

Click on the button below to access the whitepaper.