The Centers for Medicare & Medicaid Services (CMS) recently proposed a number of major updates to WRVUs in the Medicare Physician Fee Schedule (MPFS) that many experts believe will be finalized, precisely as proposed, effective January 1, 2021. The implication for organizations with WRVU compensation models is potential new losses of $50,000 to $100,000 per physician, on average. Of course, the actual impact depends on a number of variables, but in virtually every scenario, doing nothing will be very expensive.

WRVUs associated with office-based evaluation and management (E&M) visits will increase by 20% to 35%, depending on the patient mix. However, revenue will not increase, because Medicare is proposing to reduce the conversion factor by 10.6% in order to achieve budget neutrality. Thus, if physicians are paid at a market rate per WRVU, but for an increased number of WRVUs, compensation expense will increase considerably.

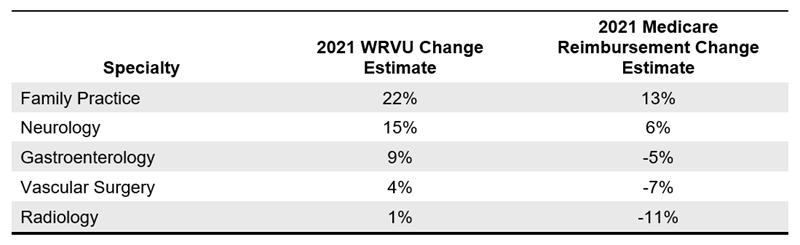

Of course, office-based physicians in certain specialties (e.g., primary care, noninvasive cardiology, hematology/oncology) will experience the most significant WRVU and revenue increases. Physicians who don’t perform many office-based E&M services (e.g., surgeons, radiologists, hospitalists) won’t see a WRVU increase; however, there will be reduction in revenue from Medicare and commercial contracts that are linked to Medicare, driving increased need for financial support to maintain compensation levels.

Preparing for Change

In future years, these fee schedule changes will affect provider compensation and production surveys that are commonly used to determine compensation levels. Many organizations that participate in market surveys submit self-reported WRVUs. As a result, most surveys—other than ECG’s—lack the ability to adjust reported WRVUs to reflect the new physician fee schedule. This is an important consideration when negotiating and/or determining market-based compensation rates per WRVU.

Every organization will be impacted differently, depending on the specialty mix, payer mix, commercial links to Medicare, payment formulas, contractual obligations, and organizational culture. In order to understand and adequately prepare for these changes, ECG recommends health system and medical group executives take the following steps:

1. Identify all circumstances where payments are linked to WRVUs. A wide array of contracts use WRVUs as the basis for financial terms (e.g., employment arrangements, professional service agreements, collections guarantee, operating expense reimbursement). Identify arrangements that may make your organization vulnerable. Additionally, note that contracts based on a “percentage of Medicare” present a similar problem and should also be analyzed.

2. Forecast compensation expense and revenue under the new fee schedule. For compensation plans that pay physicians on a $/WRVU basis, this change will have immediate impacts. The estimated WRVU and Medicare reimbursement impact due to the E&M code change for a few common specialties is illustrated below; your organization’s experience may vary based on the specific CPT code distribution.

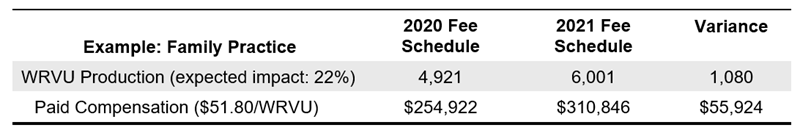

Without adjustments, the financial implications could be significant. For example, a median-producing family practice physician under a median $/WRVU plan with a 22% WRVU increase would be paid $56,000 more in compensation.

3. Quantify the expected repercussions to the group. Tabulating theindividual specialty impacts will allow your group to assess the magnitude of the overall impact. A group of 100 physicians could easily be trying to manage a multi-million-dollar net deficit, and the burden may not be equitably distributed across providers (even within a given specialty).

In addition, the fee schedule change may require the group to monitor productivity under parallel fee schedules (2020 and 2021) for tracking purposes.

4. Identify the universe of options available to mitigate or eliminate new losses. Depending on the type of contracts in place and the specific language in those arrangements, the options for adjustment could be limited. Typical strategies that organizations are already considering include the following:

-

- Use the 2020 RBRVS to value CPT code activity. Applying the 2020 schedule until actual performance data can be combined with survey data will provide stability. However, this approach may miss new and withdrawn codes. Ultimately a group could be simply putting off the inevitable contract changes.

- Rebase WRVUs using prior surveys and adjust the compensation rates. Projecting a rebased compensation per WRVU rate will allow the group to still target historical total compensation amounts (e.g., lowering the $/WRVU from $55 to $48 to reflect the larger denominator). However, 2021 activity may not actually reflect historical patterns, and actual results could be misaligned with targeted amounts.

- Incorporate collections into compensation rate determinants. Incorporating both the WRVU and conversion factor adjustments into a productivity incentive would mitigate the impact of both changes. This approach would align with another market trend toward medical group fiscal sustainability.

5. Select and implement an approach. Based on a full understanding of the financial implications and having weighed the strategic, operational, and political ramifications of the possible options at your disposal, select an approach that optimizes the outcome. The goals should be to minimize financial disruption for both the providers and the medical group and stay aligned with any strategic objectives.

Given the typical timelines of 60 to 90 days’ notice for crafting and executing mutually agreed-upon amendments to contracts, any proposed changes need to be evaluated and tested before the end of September to be in place by January 1, 2021.

A medical group’s specific tactics may be quite complicated because of the variability in impact by specialty (even to individuals within a specialty, because of differences in clinical focus) and the complexities of compensation formulas. It is important to perform financial modeling in the near term to understand how your organization will likely be affected. Having a plan in place before the new fee schedule is active will make the transition smoother.

As a part of our Physician and APP Compensation Survey, ECG offers proprietary tools and services to help medical groups and health systems understand and plan for the impact of these changes on provider productivity levels and compensation.