On November 20, the Centers for Medicare & Medicaid Services (CMS) announced an interim final rule for a new payment model: the Most Favored Nation (MFN) Model for Medicare Part B drugs and biologicals (hereinafter referred to as “drugs”). This new mandatory model is intended to align Medicare’s payments for Part B drugs with prices offered internationally for the same drugs, as well as remove incentives to unnecessarily use higher-cost drugs.

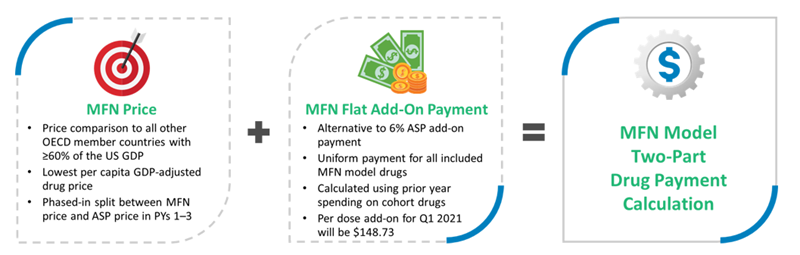

Rather than reimbursing providers a percentage of each drug’s cost, the MFN model will include a two-part payment: one is based on the MFN price and the second is a flat add-on payment for each drug dose. Providers will be responsible for negotiating with pharmaceutical manufacturers to sell them drugs at prices at or near the MFN price. Pharmaceutical manufacturers will not be directly obligated to discount their drugs.

The ambition of the MFN model is to enable systemic reductions in pharmaceutical prices for Medicare beneficiaries.

Background on Prescription Drug Payment Reform

Drug prices in the US are much higher than in other countries, and spending for Medicare Part B drugs has grown at a higher rate than other Medicare Part B services. The MFN model is a capstone of the current administration’s aim of lowering prescription drug costs and closely adheres to the “American Patients First” Drug Pricing Blueprint outlined in May 2018.

Most Favored Nation Model Details

Performance year one (PY1) for the MFN model and its provisions will begin on January 1, 2021, and continue for seven years through December 31, 2027. CMS is allowing for a comment period through January 19, 2021, despite the fact that PY1 begins on January 1. Additionally, the MFN model will be mandatory for all providers.

With only a few weeks left to prepare for PY1, below are key details of MFN that providers need to know.

1. Payment and Pricing Methodology: Instead of paying based on manufacturers’ average sales price (ASP), CMS will use a blended formula for drug reimbursement. The two-part payment combines a new MFN-adjusted price with a flat add-on payment.

The MFN price will be phased in over the first four years of the model as follows:

- 25% of the MFN price and 75% of the ASP for PY1

- 50% of the MFN price and 50% of the ASP in PY2

- 75% of the MFN price and 25% of the ASP for PY3

- 100% of the MFN price for PYs 4–7

If MFN drug prices rise faster than inflation in PYs 1–4, CMS will accelerate the blending formula.

2. Included Drugs: The MFN model will initially apply to a set of roughly 50 Medicare Part B drugs that make up an estimated 73% of the total Medicare Part B drug spending. CMS identified the top 50 Medicare Part B separately payable drugs with the highest aggregated Medicare Part B total allowed charges in the baseline period, after some exclusions, to create the initial set of drugs to be included in PY1. Annual additions or exclusions each year will follow a similar data process.

3. MFN Model Participants: The pilot will be mandatory for all physicians and providers, as well as provider organizations that receive Medicare Part B fee-for-service (FFS) payment for any of the model’s included drugs in all 50 states and US territories. In addition to the excluded provider types noted above, CMS will exclude hospitals that participate in CMMI APMs for outpatient hospital services for Medicare FFS beneficiaries on a fully capitated or global budget basis.

4. Quality Measures: The MFN model will utilize a survey-based quality measure that monitors patient experience during the model. The evaluation design will not require an independent comparison group. CMS will also conduct a “variety of analyses” to monitor access to MFN model drugs and assess the model’s early impacts.

Most Favored Nation Model’s Impact on Oncology Services

The MFN model will have the most profound impact on oncology services, and specifically medical oncology, as chemotherapy drugs are some of the most expensive drugs on the market. And in fact, the majority of the drugs included in the initial MFN model list are for medical oncology. Per MFN model supporting documentation, oncology providers are poised to experience an estimated 17% reduction in payment during 2021 in comparison to the 2019 ASP rate. That payment deficit will grow over the seven-year model. Since the add-on payment is not enough to cover the variance between the MFN price and the historical ASP rate, providers will need to negotiate down their drug prices with pharmaceutical manufacturers to make up the difference.

Our initial modeling suggests that, on average, one oncologist could see a decrease of $350,000 in revenues (assuming $4 million in drug spend and a 50% Medicare payer mix, and an average reduction of 17% in drug reimbursement). If drug acquisition costs do not track with this change, organizations may struggle to fund previous levels of physician recruitment and compensation, capital, IT investments, and operational improvements.

Next Steps for Providers

Both the Association of Community Cancer Centers (ACCC) and the American Society of Clinical Oncology (ASCO) have called on CMS to withdraw the MFN model, citing serious concerns regarding patient access for Medicare beneficiaries and adding further strain to providers’ ability to provide high-quality care. Assuming the current administration does not withdraw the MFN model this month, oncology providers need to consider several potential next steps:

- Private oncologists who previously weren’t interested in health system employment models may now be seeking the financial stability that they offer.

- Medical oncology providers may evaluate their participation in Medicare and Medicaid versus not providing care to these populations.

- Providers may need to evaluate their formularies and buy from only one or two manufacturers in order to drive volume and maximize negotiating power.

- Industry groups may need to maximize economies of scale by forming a massive GPO in order to negotiate prices with pharmaceutical companies.

- Organizations with multiple medical oncologists should institute a structure to continuously monitor and evaluate purchasing options for MFN model drugs.

- Providers should negotiate with Medicare Advantage (MA) plans to preserve current reimbursement and should then also work to drive Medicare FFS patients to MA.