Source: AJMC Original Research

More long-term and post-acute care is being provided outside of institutional settings, particularly for seniors and those with chronic conditions. The shift to home-based care will continue to grow long after the pandemic, with the healthcare continuum becoming more inclusive of home care service providers to help control costs and reduce hospitalizations. This environment creates new opportunities for home health agencies (HHAs) to grow and thrive through innovative collaboration and alignment strategies supporting population health and value-based care.

Financial Challenges and Alignment Opportunities

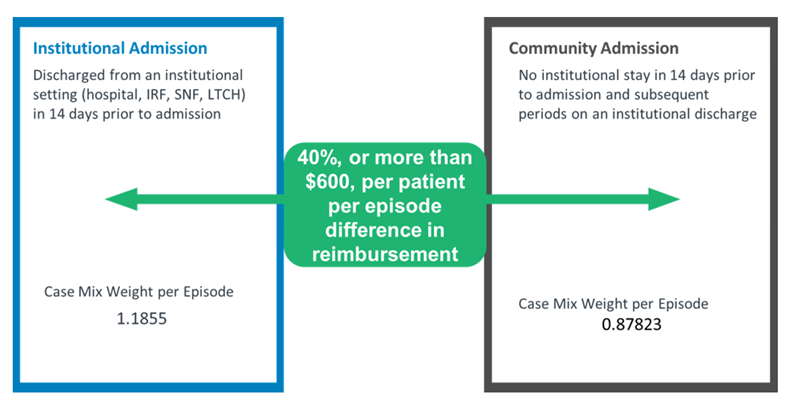

The pandemic is shifting the primary admission source for home health services away from institutional referrals toward more community referrals, which carry a lower reimbursement rate under the Patient-Driven Groupings Model (PDGM). As a result, 82% of all HHAs have seen revenues decline by 15% to 20%. Prior to the pandemic, it was predicted that PDGM alone would be too burdensome for smaller, cash-strapped HHAs, with some being forced to leave the market. Once the lifelines from the CARES Act relief funding and Paycheck Protection Program (PPP) loans disappear, financial challenges will intensify unless HHAs find ways to maintain or increase revenue.

Below are several new revenue opportunities and alignment strategies that HHAs should take advantage of in the “new normal.”

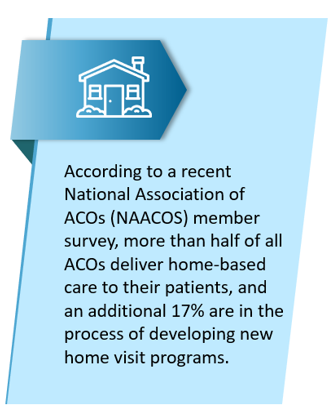

Source: NAACOS member survey

Capitalize on the shift to value-based care and population health management.

Health systems providing longitudinal care outside of hospital walls are looking to partner with home health/home care service providers, through clinically integrated networks (CINs) or other collaborative arrangements, to facilitate timely transitions of care and better manage patients with chronic diseases. With the pandemic, most accountable care organizations (ACOs) are growing their home-based care programs out of concern that patients are not getting the preventive services they need or seeking treatment when they have serious problems. While a large portion of that home care is focused on primary care, the second-leading reason for an ACO having a home visit program is to support care coordination efforts and transitions from inpatient settings to home. Organizations participating in the soon-to-be-implemented CMS Innovation Center Direct Contracting Model as Direct Contracting Entities (DCEs) are also partnering with home health and hospice agencies to promote higher-quality end-of-life care while reducing overall costs and unnecessary ICU utilization.

Home health and hospice providers can position themselves well to integrate into an ACO, DCE, or CIN by facilitating timely, seamless admissions into home care services; providing remote patient monitoring; and developing clinical programs that prevent hospital readmissions and unnecessary visits to the ED.

Make the Most of Medicare Advantage (MA) and managed care expanded coverage opportunities.

Under the 2018 Chronic Care Act and with the recent expansion of “Primarily Health Related” supplemental benefits, MA plans are now covering additional in-home services, such as adult day care, caregiver support, palliative care, and home safety devices/modifications. In addition, the MA Value-Based Insurance Design Model (VBID) includes a hospice benefit component under Part A that will cover 206 counties in calendar year 2021. This means home health, hospice, palliative care, and nonmedical home service providers have additional opportunities to develop relationships with MA plans in their local communities. Consider networking and aligning with such providers in order to expand services and capitalize on the new opportunities associated with these benefit changes. Focus on providing value to these plans by efficiently and effectively meeting their needs and demonstrating measurable quality and cost savings.

Become a preferred provider for at-risk arrangements.

Have conversations with risk-bearing IPAs, DCEs, ACOs, and providers in MA at-risk programs to become a preferred network provider of home care services. Align operational processes with high-quality outcomes, and track, collect, and share data to demonstrate the value provided by home care services to these partners. By reducing readmissions, ED visits, and fall rates, and achieving high patient engagement and satisfaction ratings, home care organizations can support and improve the performance of risk-based enterprises.

Branch out and develop nontraditional partnerships to facilitate growth.

Engage with external partners or other healthcare providers in the market, such as in-home primary care and emergency management service (EMS) providers as well as universities and technical training programs, to solve problems and create new, novel solutions in this evolving environment.

- In-Home Primary Care Partnerships: In-home primary care models often enlist the services of home health and home care providers for the care of vulnerable populations. Areas of programmatic focus may include chronic disease care, acute care, palliative care, or end-of-life care utilizing physical therapy and skilled nursing services, or assistance with activities of daily living. Integration with a home-based medical group is an opportunity to better coordinate services, improve communication, and get needed orders for home health coverage.

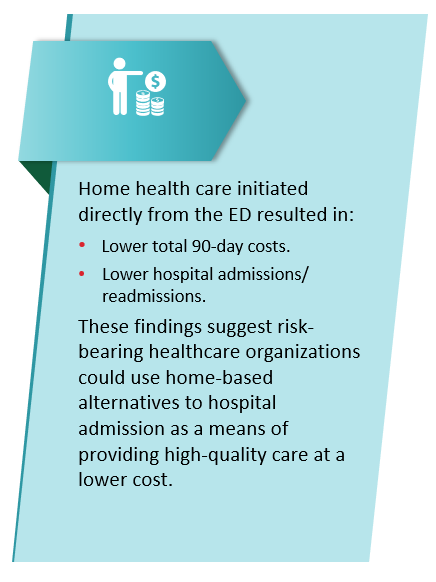

Source: NAHC Report

- EMS Collaboration: Partnerships and collaboration between EMS providers and HHAs also offer an opportunity to fill care gaps and keep people safe in their home. The Association for Home & Hospice Care of North Carolina (AHHC) is one organization advocating heavily for these types of complementary partnerships to improve health outcomes. Often after an EMS crew assesses and treats a person, that person decides not to go to the hospital. If there are issues such as frequent falls or complications with diabetes, the paramedics may need to make a referral to an HHA for ongoing skilled care or for other personal care home support services. HHAs and home care providers who have established relationships with local EMS teams will help ensure patients get referred appropriately and in a timely manner.

- University and Training Partnerships: In order to meet growing census demands, home care providers need to ramp up recruitment and retention strategies to effectively care for the increasing volume of patients with higher-acuity levels and comorbidities receiving care at home. Outside of the caregiving space, home care agencies also need support staff such as coders, billing managers, schedulers, and IT experts to run the business. Partner with universities and technical training programs to build curriculums, and provide clinical rotation and internship opportunities to create a pipeline of potential staff that are comfortable and trained for the unique aspects of home care.

An Opportunity to Grow

HHAs have an opportunity to establish themselves as indispensable partners to providers and patients. With the financial challenges associated with COVID-19, paired with the accelerated shift to value-based care and the growing desire to receive healthcare at home, now is the time for home care organizations to innovate and showcase their ability to meet health system, payer, and consumer needs.

Looking to strengthen and grow in the home care space?

Connect with ECG’s Performance Transformation experts.