A 750‑bed teaching hospital located in a major US city is filled beyond capacity—again. No inpatient beds are available. The hospital is forced to board patients in hallways and procedural recovery areas. Its emergency department (ED) has been put on diversion, sending emergency transports bearing nontrauma patients to other EDs in the area.

Scenarios like this have become common for many hospitals, particularly in urban areas, and patients are worried about whether the services they need will be available. Hospitals are concerned about maintaining quality, improving patient experience, and minimizing impact on the bottom line.

Experts have warned that more and more hospital beds will sit empty as payers push for care to be provided in less costly settings. But if inpatient volume is trending downward, why are many hospitals scrambling to find additional beds?

A Shift in Utilization

Utilization data suggests that a large portion of patient volume is not declining, but shifting: observation patients are frequently held in inpatient units and cared for by unit nurses. As a result, fewer beds are available for inpatient admissions from the ED or for those recovering from surgery.

This trend presents a strategic dilemma for hospital leadership. From a facility and capital planning perspective, hospitals experiencing bed shortages must decide whether to invest in new beds.

Should Hospitals Invest in New Beds?

As hospitals adopt new care models, it’s likely that fewer observation patients will be cared for in the hospital. For instance, telehealth gains seen during the COVID‑19 pandemic have shown that patients could be monitored in their homes with proper outpatient follow-up. Alternatively, visiting clinicians can provide support to patients recovering from surgery in their homes or hotel-like settings. Given these trends, hospitals have options beyond adding inpatient capacity to address an inefficient use of unit beds—especially since demand for bed capacity continues to evolve.

Hospitals must put the foundations in place (e.g., care management structures, technology, and digital capabilities) to safely care for patients in less expensive settings. This is quickly becoming a financial necessity, and some would argue a moral obligation. Further, alternative payment structures are becoming prevalent, holding provider organizations at risk for a greater share of total health costs.

Many hospitals need observation beds now—and will for the foreseeable future. Investing in a dedicated observation unit or units can result in a positive ROI. One study showed hospitals establishing observation units could save $1,572 per patient on average, representing revenue in addition to that obtained by freeing specialized-care beds for patients who need them. Additional cost efficiencies can be achieved by aligning the appropriate level of clinical staff per patient.

The key, however, is ensuring that facility designs are flexible enough to adapt as needed on a daily, seasonal, or emergency basis.

A Deep Dive into Utilization

Utilization data sheds further light on the issue. Across the US, there is a decline occurring in inpatient volumes, as many have predicted. National inpatient use rates have decreased at a compound annual growth rate (CAGR) of 1.0% since the Affordable Care Act was signed into law. Inpatient admissions decreased from 114 per 1,000 population in 2010 to 104 in 2015and have remained stagnant between 103 and 105 through 2019.

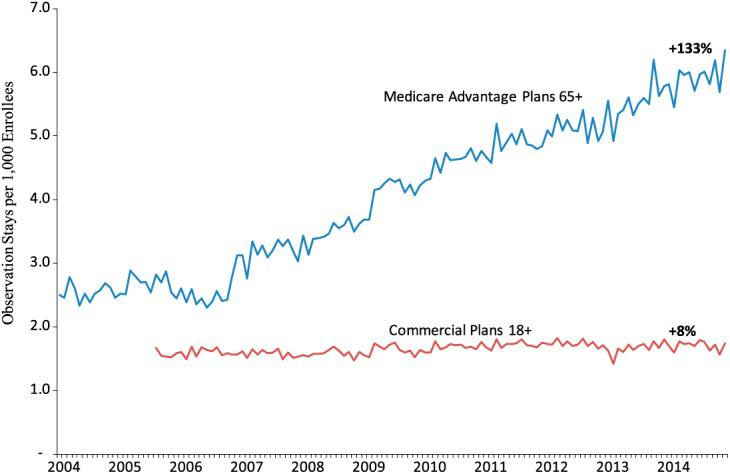

Research also shows that 24-hour-plus observation stays have increased significantly. Among Medicare patients, these stays grew 22.1%, from 2011 to 2013, a 10.5% CAGR. This trend has continued through at least 2014, and the trend is directionally true for patients on commercial plans too (although the growth is not as rapid), as shown below.

When examined together, what do these trends suggest?

According to a Medicare Payment Advisory Commission analysis , 40% of the inpatient decline can be explained by hospital patients being classified as under observation rather than admitted. This is a sizable proportion, and it helps explain why many hospitals are exploring the need to add capacity when they had planned to downsize. From a strategic perspective, it’s important to note that 60% of the inpatient decline is not explained by the shift to observation. The trend toward outpatient care is still occurring, just not quite as fast as some statistics show.

Observation Beds versus Inpatient Beds

While observation patients are considered outpatients by all payers, they often spend time in the hospital—sometimes one or two nights. But what kind of bed do they need?

It’s helpful to compare the different resource and space needs for inpatient beds versus observation beds. Inpatient rooms tend to be private, have generous footprints (260 to 300-plus net square feet at contemporary standards), and most have bathrooms. Observation beds have less stringent space and configuration requirements. Although hospital leaders want a pleasant environment for observation patients, particularly given the renewed focus on patient-centered care and satisfaction, the accommodations do not have to be as comprehensive—or expensive—as inpatient rooms.[1]

Flexible Facility Space

A solution for addressing capacity constraints is to develop a dedicated observation unit to care for short-stay patients who do not meet the criteria for admission as an inpatient, but require extended care before discharge. This option dictates resources and design that match the specific needs of these patients, including appropriate staffing levels, space configurations, and functional adjacencies. In contrast, observation patients who are placed in inpatient units can end up staying in the hospital for longer than necessary, have less uniformity in their care protocols, and are more expensively managed.

Not all observation patient types are the same. Classification can vary between:

- The clinical decision made in the ED.

- A general medical observation.

- A postsurgical extended recovery.

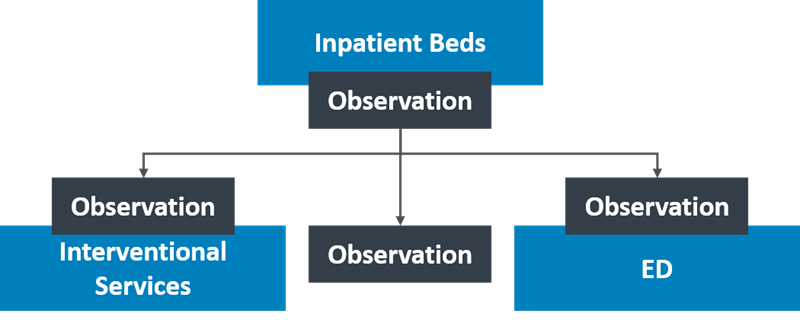

Due to staffing variations and patient needs, postsurgical extended recovery is usually accommodated in or adjacent to Phase II recovery space. Clinical decision and general medical observation patients can be combined into one space for efficiency purposes; the appropriate location for such an observation unit depends on physician coverage

(hospitalists versus ED physicians), space availability, and the degree of need to free up ED treatment rooms versus inpatient beds, as shown in the figure below.

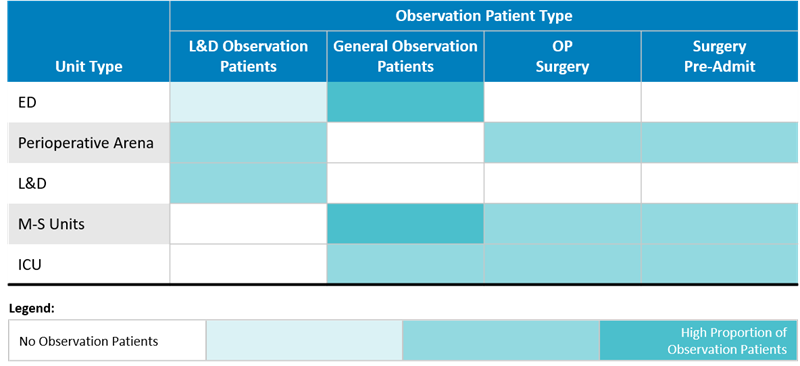

A sample of information from academic medical centers, in the table below, shows where their observation patients are bedded in the absence of an observation unit (or units) and illustrates some idea of the often diverse needs of these patients. Cardiology medical-surgical (M-S) and intensive care units (ICUs) treat a high proportion of the observation beds outside of the ED, while labor and delivery (L&D) patients are most often observed in dedicated L&D units.

Finding space for a new bed unit can be difficult; many hospitals in urban settings are facing capacity constraints. But additional options can surface when the smaller space requirements of an observation unit are considered. Several hospitals that were experiencing capacity constraints have been implementing observation and extended recovery beds in quantities equivalent to approximately 5% to 10% of their total inpatient bed capacity. This percentage depends on the specific market dynamics, the scale and service mix of the inpatient facility, and physician coverage, among other factors. In addition, a business occupancy classification should be considered for observation beds, especially for outpatient procedures, to further reduce the costs and space constraints typically associated with buildings that are designed for inpatient occupancy.

Having a scalable facility plan is important, particularly as outpatient care models continue to expand and become entrenched. To help mitigate financial risk, an observation unit should be designed with flexibility in mind to accommodate multiple patient types over time. For example, building these units adjacent to EDs is typically a good strategy. Most observation patients originate in the ED and may be cared for by ED staff, and the units can be readily converted to additional ED treatment space should the need arise. The same is true for observation units adjacent to procedural recovery or outpatient clinic space, which provide a logical expansion path for these services.

Planning for the Future

The recent census swings associated with the COVID‑19 pandemic have crystallized our thinking about how a medical center can best adapt to a sudden and perhaps prolonged influx of complex, highly infectious patients—how to triage and segregate patients based on their condition, where best to hold patients, and how to manage staff and resources. It can be challenging to balance near-term space needs with longer-term goals and projections, and observation units, by their nature, are adaptable investments for healthcare organizations to accommodate a multitude of bedded patients.

By designing scalable, flexible units for observation patients, inpatient care centers—from rural community hospitals to urban academic medical centers—can meet immediate revenue goals, provide timely care to their communities, and be primed for future demands.

Learn more about how hospitals can improve capacity today while planning for a decline in inpatient services tomorrow!

Footnotes

1. To be in accordance with 2018 FGI guidelines, each inpatient room must have natural light by means of a window to the outside and private patient toilet rooms, among other requirements.