Claims processing remains the most complex and high-risk function for payers, yet most payers rarely perform audits. Issues that stem from incorrect claims processing not only pose regulatory and compliance risks but also cost payers millions of dollars. The Centers for Medicare & Medicaid Services (CMS) estimated the improper payment rate on Medicare FFS claims in 2020 to be 6.27%, or $25.74 billion in improper payments, which speaks to the magnitude of the problem facing every payer.

Given the high error rate in claims processing, it is easy to picture how much loss is being generated from incorrectly processed claims, not just in explicit dollars but also in labor required to reconcile payment errors, review appeals, and conduct related efforts. To improve the organization’s bottom line, it is critical that payers perform frequent and comprehensive claims audits to monitor and improve quality assurance efforts related to claims processing and payments.

The Importance of a Comprehensive Audit

Many payers invest heavily in the implementation and maintenance of claims administration systems to deliver the most effective and efficient processes. Similarly, payers often deploy resources to develop and manage quality assurance checkpoints to ensure that claims processes operate as intended. These are necessary efforts, but relying solely on preset systems and applications overlooks one key element—claims processing and adjudication rules and logic are constantly evolving, and the systems and internal controls governing claims administration must evolve too. Fee schedules can change annually, quarterly, or even monthly. Providers, employers, and members can be added or terminated daily. Benefit plans, networks, and related products can be designed and introduced as needed. Although updating the claims and quality assurance processes is a part of these changes, some changes happen so fast and frequently that it is hard to manage them as they occur.

The benefit of performing a claims audit is that it does not look at one specific area, whether that be a product line or a provider contract—it looks at every aspect of the claims process, which in many ways provides a holistic view of the business. As changes are added to the claims system and processes, the once well-managed claims adjudication logic slowly starts to develop gaps, which ultimately lead to processing challenges and payment errors. Without regular audits, these errors typically are not evident until the problem becomes too big and a solution too late.

Getting Started

Since claims audits are both time and labor intensive, it is important to have a clear plan in place before getting started. Depending on the organization’s size and resources, ECG typically recommends testing at least 1,000 claims, but with the right work plan and team in place, we have performed successful audits with as few as 400 claims. Regardless of the number tested, the sample should include a variety of claims types, such as the following:

- High dollar

- Autoadjudicated

- In and out of network

- Ancillary provider

- Professional and institutional provider

The sample set should also be representative of all product lines.

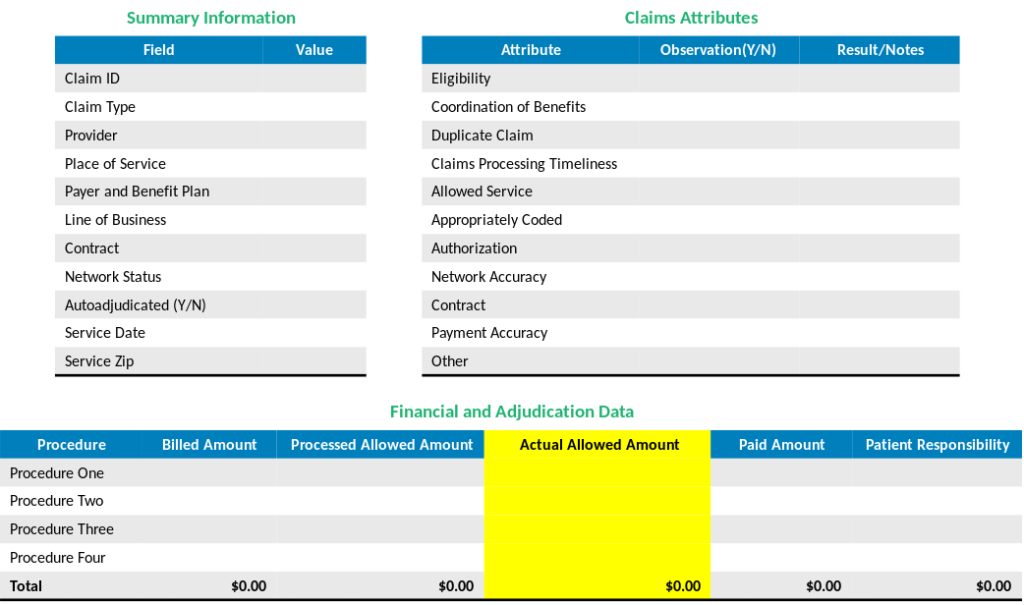

Each sample claim should be audited to review summary information, such as the provider, place of service, contract, and service date, as well as observed attributes such as coordination of benefits, the potential for duplicate claims, and payment accuracy. An example audit template is shown in figure 1.

In addition to defining the audit parameters and template, it is important to identify and interview key internal stakeholders who have a role in the claims process. Ideally, the list of stakeholders should include leaders from:

- Claims.

- Eligibility.

- Contracting.

- Business applications (or system support).

- Provider reimbursement.

- Operations.

- Medical management.

Each stakeholder should be interviewed prior to the audit so that the necessary context, documentation, and system access are provided before the audit begins. This is particularly important regarding contracting and business applications, since the necessary access to and understanding of those areas typically cause the biggest challenges in starting an audit.

Audit Pitfalls

Although taking the appropriate steps beforehand will help to ensure a claims audit’s success, there are several common mistakes to be aware of:

- Not Providing the Audit Team Sufficient Access: As noted in the previous section, it is critical that the audit team be provided access to all business applications, documentation, and data elements that are part of the claims process. Audit teams are often provided restricted system access or high-level details. This compromises the audit’s effectiveness and can cause the audit to be significantly delayed—or worse—completed without verifying important information.

- Inability to Pull the Complete Claims Universe: Payers often use multiple systems to process claims, which can make pulling claims for the entire book of business challenging and time-consuming. The data is often aggregated to a single data warehouse, but the compatibility and timing of the data extracts from various systems can make it hard to create a comprehensive file that can be used to pull a representative sample.

- Low Understanding of Provider Contracts and Fee Schedules: Most of the critical information required for a claims audit is found in provider contracts—specifically, the fee schedules used to pay the providers. Fee schedules can be updated either directly (e.g., contract amendments) or indirectly (e.g., CMS updates), but audit teams do not clearly understand many of these updates. Without a clear understanding of which fee schedule should be applied to each claim and how, audit teams can overlook or confuse critical payment details.

Many of these pitfalls are common challenges faced by payers and extend to other aspects of the business, aside from auditing claims. To that point, it is best to build ongoing processes that prevent these pitfalls outside of the claims audit so that when it comes time to perform a claims audit, there are fewer barriers for the internal stakeholders and audit team.

Other Tips for Performing an Effective Claims Audit

All companies are pressed for time and resources, which can make taking on projects such as claims audits feel daunting and overwhelming. Here are some other tips ECG has developed to effectively generate value from a claims audit:

- Rely on your data and reporting. Most payers process millions of claims each year. This generates an overwhelming number of potential claims to audit, but it also produces a sufficient sample to identify patterns and trends that can indicate problem areas in claims payment and adjudication. Before starting your audit, analyze the data to understand the full claims landscape, and then focus on noticeable trends that can guide your audit and provide the most value for your time.

- Maintain a comprehensive contracts database. One of the biggest challenges we see in claims audits is a lack of visibility into provider contracts, which are the sources of most of the claims payment and adjudication logic. It is important not only to keep contracts in a centralized location but also to configure them in a way that allows users to access and navigate them efficiently. This should be an ongoing effort, and the contracts database should be up to date before the claims audit begins.

- Include more nuanced service types and providers in the audit sample. Many audits focus too much on routine care types (e.g., office visits) and high-dollar claims. Claims for services such as office visits occur so frequently that they are less likely to be billed incorrectly. Claims above a certain dollar amount typically trigger an internal review, which also makes them less likely to be paid incorrectly. While those claims should be included in the audit sample, so should more specialized services such as anesthesia, durable medical equipment, and specialty pharmacy claims. These services are provided less often and have more nuanced billing practices, which can lead to more errors and incorrect payments.

- Check for duplicate claims. All claims administration systems have logic to prevent duplicate claims, but many systems overestimate the impact of these fail-safe measures. As noted above, this logic can gradually become outdated and ineffective. Use the claims audit as an opportunity to get a fresh view of the duplication logic and to assess whether duplicates that had been seen as outliers are becoming more frequent.

- Be thoughtful in the development of your audit template. While data will guide which claims to audit, an appropriate audit template is key in determining how you audit and what documentation is noted and collected. A good audit template strikes a balance between being thorough and being efficient and incorporates financial, operational, and contractual parameters, with a mix of both quantitative and qualitative measures.

These are just a few tips for performing a successful claims audit. Each payer should consider its own product lines, provider contracts, and internal resources and systems before developing a claims audit strategy and work plan.