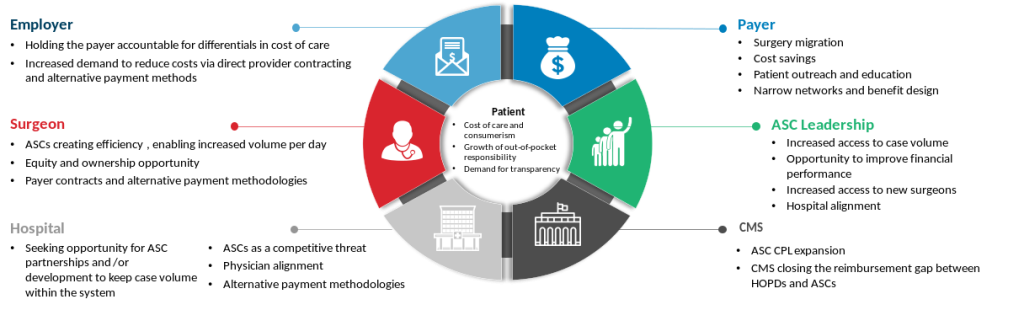

The role of ambulatory surgery centers (ASCs) in a health system’s ecosystem is essential to long-term success and will continue to expand. Hospitals and health systems without an ASC strategy will face continued pressure from revenue reductions and leakage of surgery cases that are on the Medicare and commercial payer covered procedure lists (CPLs).

In the first of a three-part series on ASC strategy, we examine the ways that surgery migration has evolved over the past 50-plus years—and what health system executives can expect going forward.

The Rise of ASCs

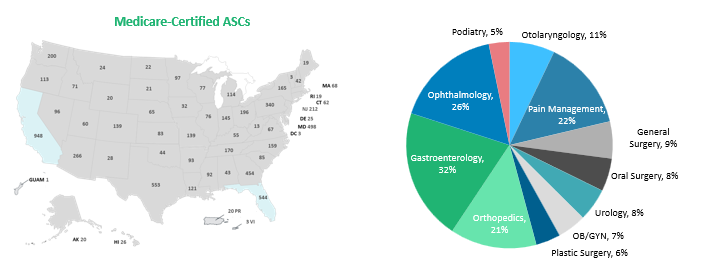

ASCs have been providing patients a cost-effective, high-quality, and convenient alternative to hospitals since their inception in 1970. In 1982, CMS approved ASCs for reimbursement, with approximately 200 procedure codes on the ASC CPL—mostly in ophthalmology and pain management.

Today there are more than 4,000 procedures on the ASC CPL, including many that were traditionally performed in hospital operating rooms (ORs) and cath labs. Some of the most significant changes to the ASC CPL that have caught the attention of hospital executives include:

- Total joints.

- Hysterectomy.

- Laminectomy.

- ACDFs.

- Breast reconstructions.

- A wide range of cardiology procedures.

The expansion of the ASC CPL represents a significant opportunity for ASCs to increase their revenue stream via access to new volume across all payers with cases that historically were only allowed in the hospital. Many of these cases are among the highest-valued cases in the hospital outpatient setting, and migration to the ASC is progressing and eminent.

The momentum for the change and increase in the number of procedures on the ASC CPL is a reflection of advances in surgical techniques, anesthesia practice, post-op recovery care protocols, and technology. The financial impact to CMS attributed to surgery migration is substantial.

- From 2011 to 2018, ASCs saved Medicare $28.7 billion.

- Between 2019 and 2028, ASCs are expected to save Medicare an additional $73 billion.

With the increased expansion of the CPL, and the increase in the number of Medicare beneficiaries, the total Medicare payer mix for ASCs is expected to continue to grow across all service lines, and the value on commercial business is expected to be exponentially greater. In just two years, the number of Medicare-certified ASCs nationally has grown by 3%, from approximately 5,910 in 2020 to 6,087 in 2022 (see below).

Evolving Perspectives on ASCs

Historically, many hospitals viewed ASCs as a threat to their surgical case volumes and overall financial performance. However, staffing shortages and OR capacity challenges were exacerbated by the impact of COVID-19 and accelerated the rapid increase in case migration from hospitals to ASCs. Additionally, CMS and commercial payers have continued closing the reimbursement gap between HOPDs and ASCs, which has pushed hospital executives to reevaluate their strategies.

Realizing that the status quo is no longer sustainable, hospital executives recognize that the pursuit of ASC ownership or partnerships is no longer optional. An ASC strategy is essential to retaining some portion of ASC-eligible surgical case volume value, coupled with reducing and mitigating leakage (which is required for physician recruitment and retention).

While some hospitals and health systems have been proactive with their ASC planning, many are still behind the curve. It is critical that all hospitals and health systems have an ASC plan; otherwise, they will continue to lose cases and surgeons to competing ASCs. Hospital executives without an ASC strategy should consider the following questions to better understand how ASC planning can prepare them for the future:

- Is the hospital/health system losing case or procedural volume to competing ASCs?

- Are there struggles with recruitment and retention of physicians?

- Are payers educating and redirecting patients to ASCs?

- Are payers denying authorizations to the hospital for patients that need a procedure that can be done in an ASC, and is the hospital losing access to reimbursement for ASC-eligible cases due to site-of-service policies that eliminate patient benefits for outpatient surgery performed in the HOPD?

- What is the competitive landscape for ASCs in the market?

- Are patients concerned with growing out-of-pocket cost responsibility?

- Are your ORs and procedure rooms at capacity?

- Are there cases in the ORs that are not profitable?

- Is there a need to enhance alignment or consider ways to partner with physicians?

- Are you interested in expanding the hospital/health system footprint in secondary markets where you currently do not have a presence?

ASC planning can be complex for hospitals and health systems with little to no ASC experience. Even those with experience commonly face challenges with optimizing the opportunity. Thus, seeking out a trusted ASC expert may be the best option for hospitals and health systems when developing and implementing an ASC plan.

In part two of our series, we’ll explore six steps for developing a successful ASC strategy. Stay tuned!

Learn how ECG’s Ambulatory Surgical Care Service and M&A practice teams help clients succeed by applying innovative approaches.

Edited by: Matt Maslin

Footnotes

1. Based on data provided by CMS, Q3 2022.

2. VMG Health 2022 Intellimarker Multi-Specialty ASC Benchmarking Study. Advancing Surgical Care (ascassociation.org).