In Brief: Your strategy for transitioning to the 2024 MPFS will depend on your organization’s compensation models.

On July 13, the Centers for Medicare & Medicaid Services (CMS) released the proposed annual Medicare Physician Fee Schedule (MPFS) for calendar year 2024.

The final MPFS will be released in late 2023 and will go into effect on January 1, 2024. CMS is currently taking public commentary on the proposed changes.

How Would the Proposed MPFS Affect Physician Compensation?

While many organizations breathed a sigh of relief at the proposed delay of the split/share evaluation and management (E&M) visits change, the reintroduction of the add-on payment for HCPCS code G2211 (primary care and longitudinal care of complex patients) code could significantly impact WRVUs and production-based compensation plans.

Under the proposal, the G2211 code would add 0.33 WRVUs to each outpatient E&M code. CMS estimates the code will initially be utilized for 38% of all outpatient E&M codes, and 54% when fully adopted. If the G2211 code is delayed or removed from the finalized 2024 MPFS, as with the 2021 MPFS, the WRVU changes would be minimal across specialties.

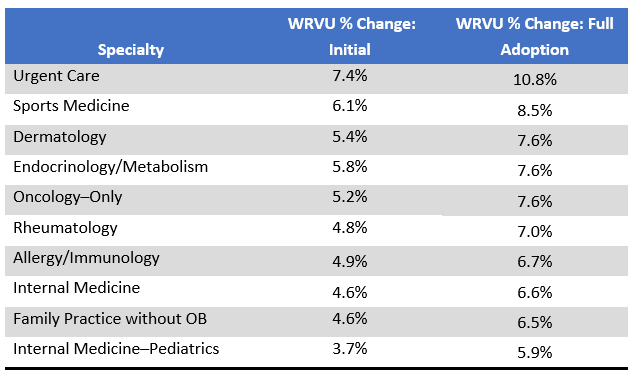

ECG calculated the projected impact on median WRVUs for all specialties under initial and full adoption of the G2211 code, as well as the other WRVU changes included in the proposed MPFS schedule. The most notable WRVU changes are detailed in table 1 for those impacted specialties.

Table 1: Projected Most Impacted Specialties by Median WRVUs[1]

While the overall changes are less dramatic than in prior years, organizations with providers on production-based models (specifically cognitive and primary care physicians) may see yet another increase in compensation. The organizations that pay on these plans, meanwhile, are not projected to receive the corresponding revenue increase because of the proposed conversion factor reduction. Specifically, CMS is proposing a CY 2024 conversion factor of $32.75, a decrease of $1.14 (or 3.34%) from the current conversion factor of $33.89.

What Now?

Your strategy for transitioning to the 2024 MPFS will depend on your organization’s compensation model(s). Here’s how you can prepare:

- Evaluate your current compensation methodologies at the service line or specialty level for employed and integrated providers to assess the impact of the changes.

- Assess the impact on PSAs and other arrangements that are funded and/or distributed on a compensation per WRVU factor, and review subsidy arrangements.

- Provide education to ensure billing and coding of the add-on code (G2211) is completed, when appropriate.

- If your organization is still referencing the 2020 MPFS for purposes of compensation, develop a transition plan for the future.

- Consider methodological and economic adjustments to ensure financial sustainability at the organization level and mitigate volatility at the service line and individual provider compensation levels.

- Because these changes might also impact the FMV determination of certain arrangements, review and audit your provider arrangements.

ECG CONTINUES TO REVIEW THE IMPACTS OF THE FINAL RULE AND ANY CONGRESSIONAL ACTIONS.

Contact our Provider Financial Services Division if you want to discuss how the 2024 MPFS will affect your planning for the coming year.

Edited by: Matt Maslin

Footnotes

1. Based on ECG’s Physician and APP Compensation Survey using CPT-level data comparing WRVUs under the finalized 2023 MPFS and proposed 2024 MPFS.