Contemplating the purchase of a medical group frequently evokes a sense of dread among hospital leadership. It might be comforting to some if group acquisitions could be considered a passing fad, but the truth is, you can expect to see continued acquisition activity by hospitals in the next decade. The major drivers will be stabilizing the delivery system, growing revenue, and responding to payment reform. Furthermore, medical groups are proactively seeking alignment with hospitals to protect compensation and increase economic stability in the face of revenue cuts by CMS and commercial payers. For the first time, both hospitals and a large segment of physicians agree that economic integration makes strategic and financial sense.

Bringing hospitals and physicians together through acquisition involves challenges that are not always recognized by the principals involved. In this article, we will discuss the critical components of completing a successful transaction for the acquisition of a medical group.

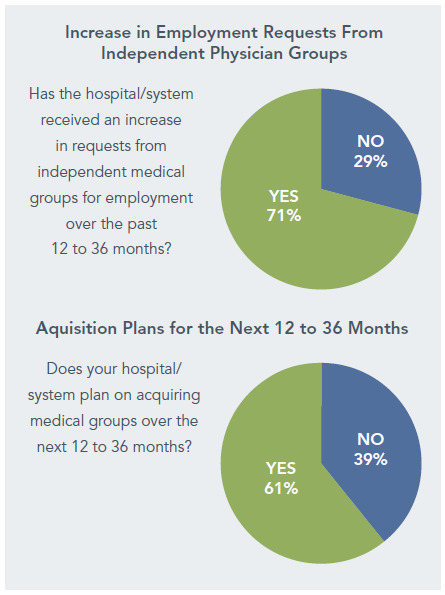

Our experience and a recent survey by HealthLeaders Media1 show the acceleration in acquisitions of medical groups.

Why Medical Group Transactions Aren’t Easy

Medical group acquisitions involve more complexity and difficulty than virtually any other type of transaction entered into by hospitals. It would be logical to assume, for example, that the merger of two 200-bed hospitals would be more complex than a hospital’s acquisition of a 20-physician medical group because of the capital required and the number of employees. The reality is that the medical group acquisition will involve more time and complexity, while generating more frustration, than the much larger hospital merger. Why? Because hospitals and medical groups are fundamentally different businesses with very different goals and ways of operating. These differences are illustrated in the following:

- Mission – Hospitals see acquisitions as part of a strategy to expand service to the community and enhance or protect market share. Medical groups, however, have a prevailing objective of preserving the compensation and lifestyle of physicians/owners.

- Governance – Major decisions in hospitals are generally made by the board and CEO. However, major and sometimes minor decisions in medical groups are often made by all physicians/owners, each of whom may assess the transaction differently and may be accustomed to decisions made by consensus.

- Management – Hospitals have many professional managers on their staffs. All except the largest medical groups have perhaps one or two management professionals.

- Finance – Capital requirements for building and equipment dominate hospital needs. Physician compensation, benefits, and tax considerations are the major drivers for medical groups.

- Operations – Midsize hospitals have thousands of employees doing very diverse tasks. Medical groups average fewer than four employees per physician in less varied roles.

While the above points are oversimplified, they are intended to generate an appreciation of the very different cultures of hospitals and medical groups. A merger of two medical groups or two hospitals is relatively easy to complete because the principals understand each other’s business and have very similar goals. Transactions between hospitals and medical groups can be expected to take considerably more time because the objectives and business methods of the stakeholders are quite different. If this is understood from the outset, the chances of reaching a successful agreement will be much improved.

The Key Components

There are seven critical steps in completing a timely and successful transaction.

1. Establishing a Shared Vision

The vision and goals of potential alignment must be addressed from the onset of planning. Far too often, organizations are well along in a transaction only to realize that they are not on the same page. Both the hospital and physicians should discuss independently, and then together, what they hope to achieve through alignment. In most cases, it is relatively easy for the hospital to articulate what alignment with physicians would result in and what the hospital hopes to accomplish. The challenge for hospitals is to retain enough flexibility to consider different ways of reaching their goals. On the other hand, for the physicians, there is often considerable diversity in both how affiliation should be structured and what benefits should be realized. It is useful to have these differences among physicians clearly identified because it can help determine which goals are most important and move the group toward consensus. Additionally, for the hospital, this process can help assess the implications of different alignment structures and ensure that the senior leadership team agrees on a preferred approach.

After clearly articulating the objectives of both the hospital and physicians, a focused dialogue will help each party gain appreciation for the other’s motivating factors and goals. It should be remembered that in addition to financial arrangements, strategic, operational, and cultural concerns must be addressed. Care should be taken to ensure that the members of physician leadership who engage in this dialogue with hospital leadership adequately represent all physicians in the group. It will behoove the hospital to ensure that the group develops an internal communication plan to keep its members up to speed – not so the hospital can control this plan, but because some medical groups are notoriously poor communicators and/or the physicians have diverse agendas.

The vision must include a high level understanding and shared expectations regarding control and “the money.

2. Determining the Model

The discussion with the physicians should involve reviewing specific models for alignment. In many scenarios, the options are poorly understood by both physicians and hospital leadership, and each may bring preconceived notions of which model is “best” – ideas that took form long before the parties’ goals were shared. It is therefore important to keep an open mind and to discuss each model in terms of its features and limitations, the mechanics of how it works, the potential financial implications, and its congruence with the parties’ objectives.

Key criteria for evaluating the models should include:

- Ability to meet physician objectives.

- Fit with overall hospital/system strategy.

- Ability to accomplish patient care and clinical program goals.

- Financial implications, including onetime and ongoing expenses.

- Feasibility of implementing and operating.

Drafting a conceptual model of the preferred arrangement(s) often helps to reveal and resolve issues and advance the dialogue among hospital and physician leadership. While there are a number of models, consideration must be given to how the physicians relate to the hospital or a sister corporation of the hospital, which is under common control of a health system.

Integration Structures

Alternative structures offer varying degrees of integration (1) among the physicians and (2) between the hospital and the physicians. Several basic types of structures2 are described below.

- Practice Management Arrangement – Physicians become employees of the hospital or health system, but the practice infrastructure remains independent and under the control of the physicians.

- Specialty Pods – Employed physicians are organized into pods based on specialty. Distinct employment arrangements, dedicated oversight, and decentralized support services are provided for each specialty pod.

- Network Model – The hospital or health system establishes a separate company or division tasked with managing the employed physician enterprise. This company/division has dedicated administrative oversight and infrastructure. As the network grows, physicians and associated support services may be organized by service focus.

- Foundation/Professional Services Agreement (PSA) Model – A group or groups of physicians are linked by a contract (PSA) to a separately incorporated organization. The corporation may employ all staff, provide all support services, and negotiate managed care contracts. This model is most frequently used in states (e.g., California, Texas) that restrict the employment of physicians by hospitals but is becoming more prevalent in situations where the physicians desire economic stability without technically being employed.

- Employed Multispecialty Group – This is similar to the network model, but it focuses on recruiting and employing physicians into a single, integrated structure with unified governance and common policies for all physicians.

The key to making an effective governance structure is to give significant authority to the physician network for a clearly defined set of decisions.

Multiple-Group/Multispecialty Transactions

Special consideration needs to be given to situations in which more than one group is being acquired or new groups are being added to an existing employed network. Resistance is likely to be high if physicians perceive that they are being forced into a larger physician structure. Often, acquired groups fear that they will be controlled, or will have their control diluted, by other physicians, regardless of specialty.

From the perspective of a hospital that is building an integrated network, there are obvious efficiencies in standardizing governance and operations under a single “authority” for employed physicians. For example, the hospital wants to avoid:

- Negotiating separate compensation arrangements with each group.

- Administering operational policies and procedures that vary by group.

- Setting recruitment needs and making hiring decisions with each group.

- Managing multiple and varied care management protocols across the employed network.

In short, for efficiency and effectiveness, a centrally governed physician network with a high degree of standardization should be sought by most hospitals, and data suggests that organizations with these characteristics perform better than their counterparts. This requires a balance with physicians who want to maintain as much autonomy as possible and retain separate compensation and patient care protocols within a larger group structure. If the hospital insists on a “one way fits all” approach to integration, it risks losing the transaction altogether or bringing in a group that is resentful of the hospital and not likely to be a willing partner.

The key to successfully integrating groups into a larger structure is for the hospital to be unwavering on the goal of a unified physician organization, while demonstrating flexibility in timing and asking the physicians to provide leadership in the design and implementation of the ultimate model.

3. Sharing Control

An important goal of medical group acquisitions is enhanced coordination of care and integration across the care continuum. Integration will require a very different set of operational activities and decision-making approaches than those of typical hospital systems functioning on their own. Integrated physician networks cannot be managed under the umbrella of the medical staff, nor can they be managed as a department of the hospital. Together, the hospital and physicians need to assume a broader role in addressing all inpatient and outpatient care, as well as work toward a more complex partnership to effectively coordinate care at all sites. Addressing this larger scope of activity is difficult even for the most advanced systems.

Governance structures that encompass physician participation will vary depending on the specific model employed by the hospital, but each model can accommodate sharing responsibility for decisions, including capital and operational budgeting, facility planning, and maintenance of accountability for performance. Balancing authority and responsibility is of course the major concern in sharing control with physician networks.

The key to making an effective governance structure is to give significant authority to the physician network for a clearly defined set of decisions. Hospital and physician leadership should determine the authority of the hospital; medical group; and any board, operational committee, advisory council, or similar structure formed as part of the transaction. The parties should then identify the rights/obligations of each to:

- Be informed of decisions of management or other governance bodies.

- Provide advice to decision makers prior to final resolutions.

- Approve specific policy or operational decisions.

- Retain special majority or reserve powers regarding specified actions, possibly including sale of assets, changes to the compensation system, acquisition of other medical groups, and purchase of a new electronic medical record (EMR).

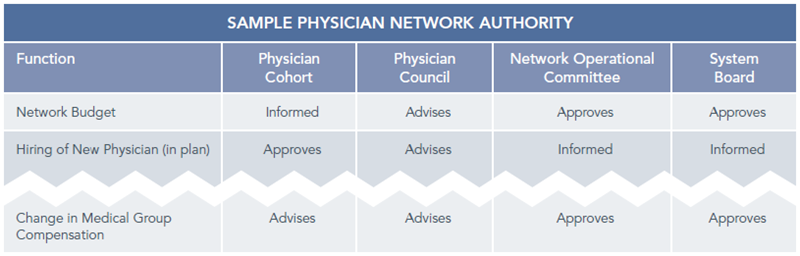

Preparing a matrix that defines these rules can be very helpful in clarifying governance responsibilities. A simplified matrix of authorities for a typical physician network is shown below.

Note that many decisions require both network operational committee and system board approval, which promotes a true partnership in major decision making. The important point is that authority is delegated to the greatest extent possible and that the roles of the various entities are clearly defined in advance. The dialogue required to create a suitably complex governance matrix is one of the defining events of a successful transaction. “Stress testing” the governance structure by proposing typical scenarios and walking through the potential structure can also be helpful.

4. Setting Physician Compensation

It is no surprise that compensation is at the top of the priority list for physicians and that emotions can run high during the negotiation process. Even if agreement is reached on the initial compensation structure, it will most certainly be a recurrent topic for discussion and revision after the transaction is completed. These negotiations are frequently more contentious and complex than they need to be. The basic issues are compensation methodology (how the physicians are paid) and compensation levels (how much they are paid). While this Insight will not delve into the details of the many options for compensation, there are some basic points that should be remembered during the transaction process.

- Accept a transition to a consistent compensation model. As previously noted, a hospital’s successful integration of a group into a larger structure often requires flexibility in timing. A provision of many medical group transactions requires the hospital to maintain the acquired group’s existing compensation practices for some period of time.

- Keep the compensation system simple to administer. Metric-driven models must have accurate and timely reporting of sophisticated data and often require a comprehensive EHR, along with significant investment in data analysis, a tolerance for less-than-perfect information, and an infrastructure for quality and resource management. A complicated solution may be beyond the capabilities of the organization, especially during the initial years of an affiliation.

- Keep the compensation formula easy to understand. While it is absolutely correct that physician behaviors reflect economic incentives, using too many variables to determine compensation can create confusion among the physicians that will delay and dilute the impact of the intended incentives. Ideally, every paycheck should be accompanied by a performance report that shows physicians the relationship between what they do and what they are paid.

- Consider the implications of a new compensation methodology. Physicians in independent practices tend to pay themselves based on metrics that closely mirror the financial contribution that each physician makes to the group. Frequently, compensation is calculated by applying the physician’s direct expenses and allocated overhead to the physician’s collections. Hospitals tend to pay physicians based on WRVUs, with bonuses for quality, citizenship, and other performance measures. When moving a physician from a profitability-based compensation formula to one where resulting compensation is not directly impacted by expenses, payer mix, collections performance, etc., a hospital may find that the physician’s incentives no longer correspond with the financial health of the practice. Other mechanisms, such as peer pressure, robust performance reporting, or a strong organizational culture, will need to fill this gap.

5. Considering Value-Based Compensation Features

Future payment changes will fundamentally alter the way that provider organizations are reimbursed. Hospitals that employ physicians should be prepared to adjust compensation to account for these new incentives and revenue streams. However, avoid moving too far ahead of reimbursement changes. For now and the next several years,3 fee-for-service will continue to be the dominant form of payment to providers, and the compensation of physicians should reflect this reality.

6. Agreeing on Valuation

In any transaction, there will be differences between the perspectives of buyer and seller, and the purchase of a medical group is no exception. Our experience shows that physicians often have unrealistic expectations, and hospitals too often overpay in an effort to complete the deal. In many, if not most, medical group acquisitions, misunderstanding arises about the appropriate price for “goodwill” or other intangibles. Physicians often believe that a premium should be paid for the business in place, established revenue stream, ancillary business, name, reputation, and other assets. Most often, market value of tangible assets is the appropriate price and, while not trivial, the amount paid to each physician can be disappointing.

To avoid having this issue derail the deal, we often recommend that a qualified third-party valuation firm be selected jointly by the parties. The physicians may still feel disappointed, but they will be less likely to direct any negative sentiments at the hospital.

It needs to be understood by the selling physicians that competitive, stable compensation and benefits – rather than a big buyout check – should be the goal.

Physicians need to understand that some practice modifications will be both necessary and appropriate, but that they will not be made without careful deliberation and discussion.

7. Planning Integration

Signed documents are a cause for celebration and recognition of the hard work that has been accomplished. However, the new entity cannot be fully functional until financial and operational integration is complete, and the integration process should be planned for and specified well in advance of the transaction’s closing. A detailed implementation plan should be developed that specifies the tasks required and who is responsible for completion. It is important to remember that this will likely be the first time that line managers from either organization are involved in the transaction, which means that orientation on the details of the acquisition and introductions of participants are the initial steps. Sample topics in an implementation plan include:

- Conversion of the billing system and collection of prior-entity receivables.

- Integration of physician operations into the hospital purchasing system.

- Transfer of employees, HR, and payroll/benefits from the medical group to the hospital or new entity.

- Integration of accounting (revised chart of accounts, crosswalk protocols, etc.).

- IT integration, including EMR.

- Third-party payer contracting changes (revised rates, TIN changes, etc.).

- Credentialing by the hospital and payers as required.

- Service contracts/leases assigned.

- Compliance training.

There are many moving parts to integrate a medical group into a hospital structure. Decide which efforts are mandatory and which can be deferred, and identify how much you can realistically accomplish in the first year of operation. Quickly integrating a medical group into a hospital’s operational and governance systems may be appealing for many reasons; however, the administrative capability and political will of the organization may simply not support full integration in the near term.

During the transaction process, it is critical that both the hospital and the medical group avoid assumptions that are not supported by analysis or experience. The following are two examples of assumptions that can lead to significant problems during and immediately afterthe transaction:

The Hospital Will Run Acquired Practices More Efficiently

Independent physician practices may not have the latest and greatest management systems, and they may be unaware of or ignore some basic management rules, but they run as if every dollar spent comes out of the owners’ pockets, which it does. Hospitals can often bring better management to medical groups, but they are rarely able to manage practices at lower costs. More likely, overhead items such as benefits for staff and physician employees, IT requirements for meaningful use, paid physician management time, compliance requirements, hospital overhead allocations, and other incremental costs result in less efficient operations.

Physician Practices Won’t Change After the Affiliation

During negotiations, both physicians and the hospital often foresee little or no changes in the actual practices after the transaction. They reason that practice locations and staff will remain the same, and the hospital gives assurances that it has no interest in telling the physicians how to practice medicine. The reality is that changes are inevitable if quality is to be improved and costs reduced. In many instances, patient care protocols will be introduced, provider evaluations will be initiated, referral patterns will be changed, and an EMR will be introduced (including physician training requirements). To avoid conflict when changes are proposed, physicians need to understand that some practice modifications will be both necessary and appropriate, but that they will not be made without careful deliberation and discussion. Prior to executing the transaction, it is important that the physicians recognize (1) what changes will likely occur to their routines, (2) why the changes may be necessary, (3) how physician leaders will be included in making such decisions, and (4) that hospital leadership understands that these changes can be stressful and may temporarily reduce productivity.

Is There an Easier Solution?

With a clearer picture of what is involved in acquiring a medical group, the logical question is whether there are alternatives that are less time-consuming and expensive. While hospital integration of medical groups is just one of a number of options for affiliation, in our view it remains the most viable structure in terms of effectiveness and stability. Other structures – purely organic growth, comanagement agreements, or joint ventures – typically have strategic, timing, regulatory, or effectiveness issues of their own. To paraphrase Sir Winston Churchill, acquiring medical groups is the worst form of integration except all those other forms that have been tried from time to time.

From our experience, group acquisitions are likely to be an important component in building your integrated system. You should take advantage of opportunities to acquire groups when doing so is consistent with your overall strategy. The transaction process is complex, but it is manageable (with the right skill set) and can be very effective in propelling the combined entity forward.

Footnotes

1. Physician Alignment in an Era of Change, HealthLeaders Media survey, September 2010.

2. For details on these structures, visit ECG’s Web site (www.ecgmc.com/organizational-design-development).

3. See “Preparing for Payment Reform: A Whole New Ball Game?” ECG Insight, Spring 2011.