As hospitals, health systems, and academic medical centers (AMCs) begin to evaluate their first series of physician transactions (e.g., employment, Professional Services Agreement [PSA]) that occurred during the past 3 to 5 years, many are now revisiting the fundamentals of physician compensation. The central challenge for most organizations is to develop physician incentives that drive productivity and quality while ensuring that compensation remains grounded in the fiscal reality of the organization – an aspect of plan design that is often overlooked (e.g., during the 1990s). As such, the long-term financial feasibility of past approaches that merely index compensation to benchmarks (e.g., median compensation per WRVU) and assume health systems take on full financial risk are beginning to be questioned. While compensation plans will ultimately be shaped by local market conditions and the evolution of reimbursement methodologies, below are five emerging trends to watch nationally.

1. Community and Clinical Faculty Compensation Have Yet to Merge

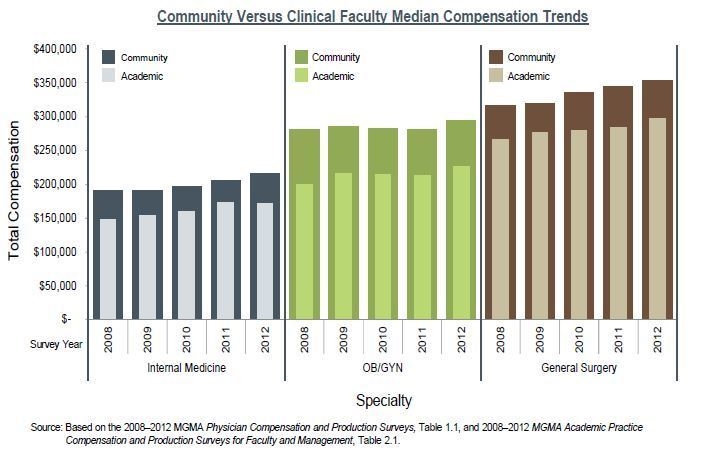

With perhaps the exception of major service lines or centers, the design of compensation models and targets for community physicians and clinical faculty remain distinct and separate. Many AMCs with a high number of employed community physicians are currently focused on consolidating infrastructure and have not seen an immediate need to ensure parity between academic and nonacademic physicians. This trend is highlighted by survey data (see figure below), showing a consistent variance with respect to reported compensation for most specialties over the past 5 years. In some cases the gap may even be increasing, as with internal medicine, where the gap has averaged approximately $49,000 over those 5 years but increased to almost $60,000 in 2012. While there are many factors that may contribute to this income disparity (e.g., productivity, the use of residents and/or extenders, nonclinical duties), AMCs should be proactive in designing hybrid compensation models that ensure consistency across the enterprise with regard to clinical compensation, as the consolidation of community physicians and clinical faculty will continue to rise.

2. Productivity-Based Compensation Continues to Be Dominant

Despite a renewed focus on quality and value, as well as the expectation that the market will migrate away from a utilization-based system, productivity-based compensation models are nearly standard across high-performing health systems and top-tier AMCs. While the percentage of total or expected compensation paid through productivity based incentive varies, nearly two-thirds of providers pay over 50% of salary based on productivity. WRVUs remain the most popular metric used to measure productivity. Depending on the specialty, WRVUs may be replaced by or augmented with other productivity metrics that better reflect the goals of that specialty (e.g., the number of new patients seen in the cardiology clinic). Additionally, WRVUs continue to be the prevailing metric used for PSA payment arrangements. Although WRVUs continue to be dominant, organizations should start to consider blending alternative features into their compensation models that are consistent with their managed care strategy (e.g., payment to primary care physicians [PCPs] for panel size) as reimbursement shifts from fee-for-service to partial- or full-risk arrangements.

3. Quality Incentives Are Emerging Slowly

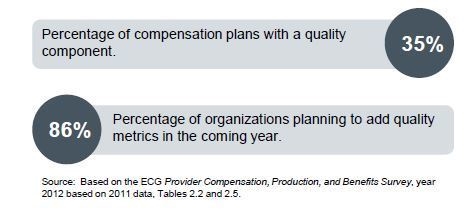

There is significant interest in attributing more compensation to quality-based components, partially in response to and in preparation for payment reform; however, these types of arrangements are still evolving. Many health systems are either struggling to define quality metrics and/or lack the proper systems to accurately track them. For organizations that link compensation to quality metrics, the percentage of compensation tied to these metrics is relatively modest (i.e., approximately 5% to 10% of expected or targeted compensation). Nonetheless, this percentage is expected to grow, and organizations should take preparatory steps now to build an infrastructure and processes that measure and track tangible quality metrics with the anticipation that these changes will have a growing influence on physician compensation.

4. Benchmarks Are a Necessary Guide but Are Not a “Price Sheet”

Defining market compensation continues to be a challenge, and nearly all AMCs and health systems utilize one or more national benchmarks as a guide to both set competitive compensation and ensure that fair market value (FMV) is not exceeded. However, the tendency to adopt a single benchmark or percentile is fading. This stems, in part, from the rising compensation per WRVU amounts reflected in the benchmarks during this time of market consolidation (which is inflating compensation for certain specialties). In turn, this is causing the loss per physician to rise during a period of heightened pressure from health system boards to reduce/manage costs. Benchmarks may serve as a guide, but local transactions are effectively setting market value. Many progressive health systems that we have worked with are augmenting national benchmark data with information provided directly from peer organizations as well as local market intelligence. Particularly during this time of rapid consolidation and change, organizations should not rely solely on national benchmarks but be prepared to make assumptions and adjustments based on retention and recruitment trends locally and insight gathered from peer organizations nationally.

5. Links to Financial Performance Are on the Rise

While preserving productivity-based components and with an eye toward quality, many health systems are taking a more aggressive approach to linking the payout of incentives or at-risk compensation to the availability of resources through the physician organization. In some instances, organizations are linking physician compensation to overall system performance as the loss per physician continues to rise nationally. Common metrics include the ratio of collections to compensation, gross operating margin (collections less direct expenses excluding physician compensation), and overall net margin of the business unit/practice. This approach not only supports the financial viability of the group but also helps combat the growing concern that physicians will transition from the cost-conscious mentality of private practice to a solely individual productivity-based mind-set as a result of being paid on a per WRVU basis that does not take into account the cost structure of the physician organization and/or health system. Accordingly, organizations should reconsider productivity-only compensation models and actively seek opportunities to place a portion of compensation at risk based on financial performance.

Conclusion

Although not traditionally the case, approaches to physician compensation are quietly becoming a source of market differentiation. Organizations that align physician incentives with emerging reimbursement models and the organization’s strategic goals, while building in appropriate financial safeguards, will ultimately have a competitive advantage in their local market. Furthermore, as the prevalence and cost of these arrangements grow, organizations will benefit from taking a proactive approach in reviewing their physician compensation arrangements, rather than waiting for the entire market to shift.