Nothing quite captures the simultaneous permanence and uncertainty of the choices healthcare providers face as much as a solid steel I-beam dangling from a crane. Major physical investment strategies hang in the balance. The high-dollar decision to set that very permanent steel girder into place had better be made through a future-focused lens because it’s going to spend at least 30 years holding up a building that will operate under a care delivery model that may not yet be fully defined.

Most executives are grossly underestimating the level to which utilization has the potential to drop.

The industry has spent decades developing its fixed-asset platform for a fee-for-service reimbursement model. Aligning physical assets with the volume-to-value push will take time. Exactly how that transition will happen and how quickly it will take place are largely unknown, but hospitals and health systems must make investment decisions today about facilities that tomorrow will be viewed as cost centers instead of revenue drivers.

Developing an appropriately informed physical asset plan for a value-based delivery network is imperative to avoid significant, unnecessary capital expenditures and to reduce operating costs. This plan must consider ways to:

- Develop a delivery system that is attractive to payers and large employers

- Meet the needs of a large, diverse and geographically dispersed population

- Reduce per-unit operating costs

- Reduce excess clinical capacity

While the value-based network plan may not be implemented immediately, it should drive decisions on major asset investments as capital requirements surface. We can confidently make some general assumptions about the future, which will help health systems plot out the ideal distribution of assets.

1.UTILIZATION RATES WILL DROP

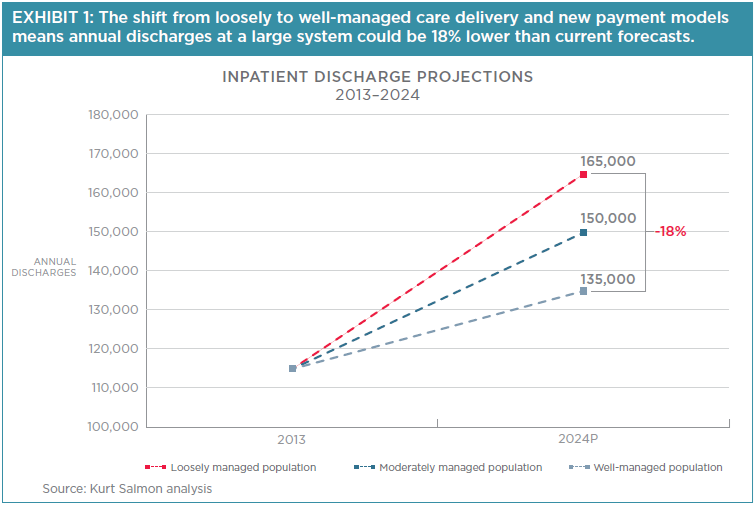

Provision of “well care” as opposed to “sick care” will accelerate over the next five years. New care delivery and reimbursement models, a focus on population health, and increased pressures from payers will shift inpatient utilization rates at hospitals downward, even as the population continues to grow and age. (See Exhibit 1.)

While this is generally understood, most executives grossly underestimate the potential drop in utilization. A March 2014 Kurt Salmon survey of U.S. hospitals and health systems found that 63% of executives and board members expect a decrease in utilization of all inpatient services over the next five years (measured by admissions per 1,000 population); the average expected decrease was 3%. But estimates calculated using Milliman’s Health Cost Guidelines (HCGs) find that markets which shift to well-managed rates may experience as much as a 30% reduction in inpatient admissions when compared with current levels (which are already 10% lower than five years ago). This calculation factors in actual, observed data from plans and providers with more mature population health-management methods in place.

Executives must consider these likely reductions and get more conservative with long-term capital asset planning. The transition to risk-based payment will require removing significant unnecessary utilization capacity.

2.EXCESS CAPACITY WILL BE PREVALENT

Assuming utilization rates drop, most markets will have excess beds and diagnostic and treatment capacity. Assuming modest reductions of 10% in utilization and one day in length of stay, the United States will require 100,000 fewer beds, even after accounting for an aging and growing population. Providers will be able to purchase or lease beds at very reasonable rates. Further, digital technologies will affect how and where care is provided; physical locations will no longer be the automatic default for patients seeking care, and executives will need to shift their strategies to adapt to evolving patient expectations and to prevent costly overbuilding. This extra lower-cost capacity must be factored into the equation when determining the value that renovated or new assets will have in the future and whether the system should consider physical expansion.

3. PRESSURE TO CONSOLIDATE SITES OF CARE WILL RISE

Most health care organizations will need to significantly lower their cost structures to maintain their viability moving forward. This requires reorganizing the care delivery network, aggregating services to simultaneously:

- Gain economies of scale and ensure high asset-utilization levels

- Maintain or enhance quality and patient satisfaction

- Provide convenient access to care

Many health systems have acquired a hodge-podge of buildings over the years, leading to duplicative services in some areas. In other cases, changing migration patterns and suburban growth have moved the target population further away from facilities.

Now it’s time to recalibrate the scale. Before initiating expensive facility renovations, health systems must consider the role each asset will play in their care delivery networks over the long term. They must balance the number of access points they offer with their ability to achieve lasting success.

4. PHYSICAL INVESTMENTS WILL BE SUNKCOSTS, NOT REVENUE DRIVERS

The costs of renovating or building new facilities pale in comparison to the costs of operating them over their lifespan. With a decreased ability to recoup capital investments in a value-based reimbursement environment, most of these assets should be thought of as cost centers in the future. Among the questions to ask before putting capital toward building or renovating an asset are:

- Is there a sufficient population to support it, and can we offer services at sufficient scale to create economies?

- Do other system facilities nearby serve a similar function and market?

- Can the service be conducted in a lower-cost setting?

- Is it convenient for patients?

- Can potential partners in the area provide a similar or higher level of value?

- Are we trying to use capital solutions to solve operational problems?

Health systems must consider how their asset portfolios will evolve in the future to guide their investment decisions. Conservative planning in the midst of this rapidly changing healthcare environment is recommended, as it is more sensible to build or acquire assets in the future when needs arise than to risk overbuilding today.

The significant opportunity to remove duplication and waste and to create value will have a dramatic impact on the healthcare marketplace. The providers that move early to recalibrate for value-based care delivery will have a distinct market advantage over those that hang on to the old ways of doing business. Executives must change their mindset accordingly, steering away from traditional “grow-and-expand” strategies and toward “assess-and-reorganize” strategies. Unless hospital executives are incented by system or regional goals instead of the growth and financial health of their respective hospitals, change will be slow going. The health systems that are able to lower excess utilization and significantly reduce their cost structures have the potential to go to market at a substantially lower price point and shift a considerable number of lives and amount of market share to their delivery networks. Physical assets will have a considerable impact on the process.

Systems must plan for a future where their care delivery networks may need to be significantly different. Recalibrating for value-based network design requires difficult choices about assets and locations, but it provides the necessary fulcrum for becoming a high-value healthcare provider. Doing the hard work now has the potential to save billions of dollars in capital and operating costs down the road.

Conservative planning.….is recommended, as it is more sensible to build or acquire assets in the future when needs arise than to risk overbuilding today.

The significant opportunity to remove duplication and waste and to create value will have a dramatic impact on the healthcare marketplace. The providers that move early to recalibrate for value-based care delivery will have a distinct market advantage over those that hang on to the old ways of doing business. Executives must change their mindset accordingly, steering away from traditional “grow-and-expand” strategies and toward “assess-and-reorganize” strategies. Unless hospital executives are incented by system or regional goals instead of the growth and financial health of their respective hospitals, change will be slow going. The health systems that are able to lower excess utilization and significantly reduce their cost structures have the potential to go to market at a substantially lower price point and shift a considerable number of lives and amount of market share to their delivery networks. Physical assets will have a considerable impact on the process.

Systems must plan for a future where their care delivery networks may need to be significantly different. Recalibrating for value-based network design requires difficult choices about assets and locations, but it provides the necessary fulcrum for becoming a high-value healthcare provider. Doing the hard work now has the potential to save billions of dollars in capital and operating costs down the road.