The Medicare market is swelling as the nation’s aging population continues to grow. While this was anticipated by those in the industry, what is particularly interesting is the concurrent rise in popularity of Medicare Advantage (MA) plans. Many predicted that MA growth would decline due to the funding changes outlined in the Affordable Care Act (ACA). Yet data indicates that Medicare eligibles are increasingly choosing MA over traditional fee-forservice (FFS) Medicare.

So why are MA plans becoming more popular, especially after many predicted a decline in MA enrollment with passage of the ACA? Well, they are attractive to the Medicare-eligible population due to their limits on out-of-pocket spending, the availability of low- or zero-premium plans, and the access the plans offer to extra benefits such as vision, dental, and wellness programs. Further, many new Medicare eligibles have a long history with employer-sponsored insurance and value insurance company service capabilities when questions about coverage and benefits arise. The Henry J. Kaiser Family Foundation reported that enrollment in MA plans accounted for nearly a third of all Medicare membership in 2015.1 For provider organizations, the potential to strengthen their bottom line while forging a path to value-based care makes offering a provider-sponsored MA (PSMA) insurance product exceptionally attractive. Nearly half of the entities now operating MA plans are provider sponsored.2 And this uptick in the formation of PSMA plans shows no signs of slowing.

Yet despite the profitable market growth potential for provider organizations, hopping into competition with well-funded regional and national payers is obviously risky. MA plans represent significant strategic, financial, operational, and regulatory risks with dynamic funding sources and sizeable potential penalties for poor quality performance. So if you’re going to get into the PSMA business, you’d better get it right from inception, because mistakes can be very costly.

Whether you are a provider group considering sponsoring an MA plan or are operating a plan that is not performing to your expectations, this article offers best practices for creating a high-performing PSMA plan.

UNIQUE CHALLENGES IMPACTING PSMA PERFORMANCE

Creating successful PSMA plans doesn’t just happen. There is often a natural cultural tension that exists between the provider and health plan components of these organizations – often expressed as the “cost” versus “care” paradigm. Providers have a natural inclination to improve health, regardless of cost. However, the health plan, working within fixed capitated revenue, must focus on cost without compromising quality. Managing this dynamic is a challenge that necessitates strategic leadership and deliberate planning so alignment and commitment can be developed across the organization. Operating a high-performing PSMA plan also requires that management understands and responds to a complex regulatory environment with shifting dynamics and numerous near- and long-term challenges.

Fixed and Potentially Declining Capitated Payments

MA plans operate on a relatively fixed budget and capitated payments. CMS calculates capitated payments annually based on a plan’s projected cost of delivering services to its members. If a plan’s projected costs (i.e., its “bids”) are less than the statutory benchmark that varies from county to county, the plan receives a “rebate” that it must use to provide extra benefits, making the plan more enticing to enrollees. As a result, the PSMA plan’s ability to control costs for medical services will have a direct impact on plan marketability and revenue potential.

Plan financial performance is threatened, however, by the potential for declining capitation rates. The government payment formula for MA plans was changed significantly as part of the ACA in an effort to reduce spending and align costs more closely with the traditional FFS Medicare program. In addition, CMS decreased per capita MA rates (the national average) in 2016 by 0.95%, only a slight increase of 1.05% when risk adjusted. For 2017, payment rates will increase by only 0.85%, or 3.05% when risk adjusted, but many have argued that there will be effectively no increase when other MA payment policy changes are taken into consideration. Recently, the Medicare Payment Advisory Commission (MedPAC) backed recommendations to reduce plan payments under MA, and MedPAC continues to support legislation from Congress to eliminate the potential double bonus payments created under the pay-for-performance program. These cuts have the potential to reduce rebates and the availability of extra benefits, which are attractive components of private Medicare plans when compared to traditional FFS Medicare. While MedPAC’s recommendations are not legislatively binding, the organization’s position on MA payments and its significant influence in policy decision-making represent a risk to the primary revenue stream for MA health plan issuers.

Importance of Quality and the Stars Rating

MA plans are eligible for 5 Star rating bonus payments as an incentive to improve quality. Stars is a comprehensive quality rating system that assesses an MA plan’s performance across five domains: keeping patients healthy, managing chronic conditions, providing adequate access to care, limiting member complaints and retaining members, and providing strong health plan customer service.

The incentives and consequences for high or low Star ratings can be significant. First, these ratings can influence enrollee choice in MA plans. CMS flags plans that are rated 3 Stars or lower3 as being low performing on Medicare Plan Finder and issues a financial penalty. Plans rated at less than 3 Stars for 3 consecutive years run the risk of CMS contract non-renewal.

Star ratings also have significant financial impacts on the plan. For the first 3 contract years, the plan will receive a 3.5% adjustment to premium. Starting the 4th plan year, however, plans with 4 or more Stars receive bonus payments of up to 5% of premium that can be used to lower premiums, enhance benefits, expand profits, reduce cost sharing, or some combination of these options. Plans with a 5-Star rating can enroll members all year (beyond the 7-week annual enrollment period) and receive the maximum bonus.

Plans with 3 or fewer Stars receive a 0% adjustment to premium, putting the plan at significant disadvantage. If a hypothetical regional health plan with half a million members and bids lower than the county benchmark during a 2-year period were to decline from a 4- to a 3.5-Star rating, it would lose rating bonuses and rebates measuring tens of millions of dollars.

According to CMS, about half of all MA plans earned 4 Stars or higher for their 2016 overall rating. In addition, plans built around integrated delivery networks reportedly received a higher weighted average rating (4.45 Stars) than plans offered by commercial carriers (3.96 Stars) or Blue Cross Blue Shield carriers (3.86 Stars).4 In short, PSMAs have a demonstrated track record of outperforming traditional health insurers.

ACTIVITIES TO SUPPORT PERFORMANCE OPTIMIZATION

There is little intrinsic value in merely operating a PSMA plan, and it’s how measurably well the plan operates that determines value. Optimizing PSMA plan performance requires strategic vision, cultural reconciliation of the “cost” versus “care” paradigm, and sound execution. To be a high-performing PSMA plan, the organization’s leadership team must make strategic decisions at the enterprise level while recognizing that there will be an acceptable and natural operational tension between the provider and the payer components of the system. The vision of success is when the provider and payer components are truly working in collaboration to create a differentiated and highly performing product and service for the market, which includes members, patients, employers, and so on.

As previously mentioned, a PSMA plan’s ability to control medical costs will have a direct impact on plan marketability and revenue potential. Furthermore, an October 2015 analysis conducted by Oliver Wyman suggested that payer-driven Star measures have become “high and homogenous,” with plans in roughly 50% of U.S. counties averaging 4 Stars or higher on the payer-oriented measures.5 The analysis then suggests that performance on provider-driven measures is relatively low and much more variable, presenting an opportunity for plans to differentiate themselves from the competition. Noting a nearly perfect statistical correlation between provider-driven measures and all domain measures, the analysis concludes that “[u]ltimately, a health plan’s Star rating is defined primarily by the behavior of its providers.” 6

So what can organizations with PSMA plans do to optimize plan performance?

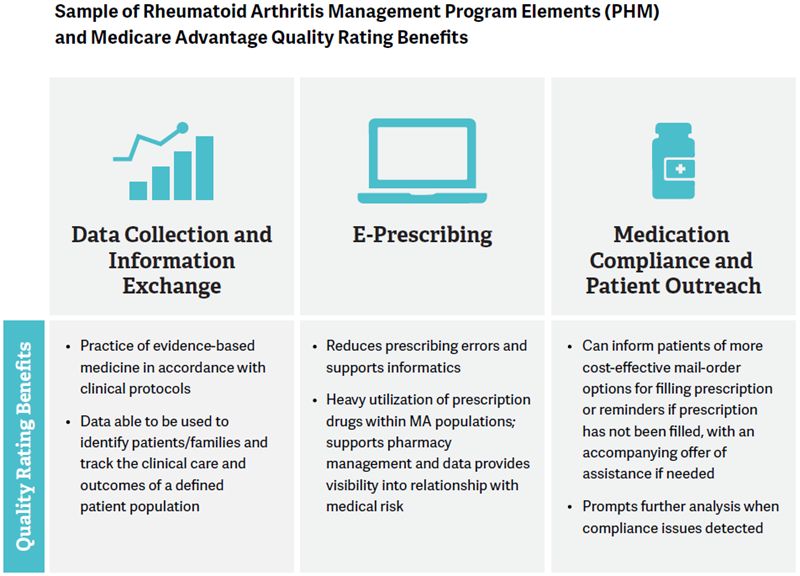

Data Collection and Information Exchange

Make sure you have adopted strong provider data collection practices, selected the right EHR, configured systems to meet all data collection needs, and integrated actionable information into provider workflows.

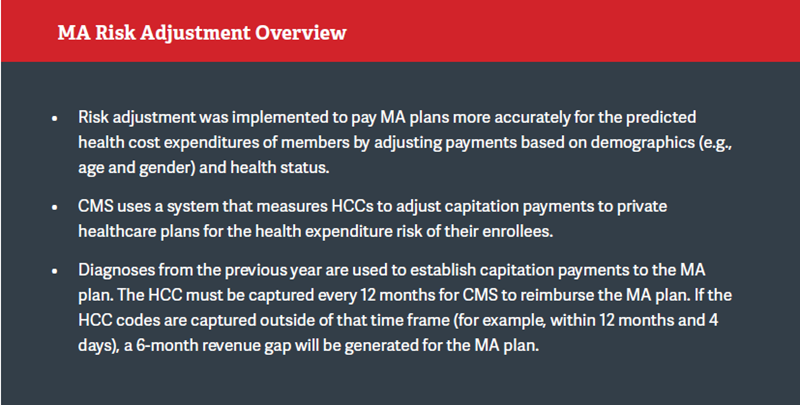

Data collection supported by accurate Hierarchical Condition Category (HCC) coding and clinical documentation and information exchange supported by the provider’s EMR system enable the MA health plan to accurately project and defend risk adjustment accruals and bonus payments. An MA plan’s ability to collect accurate clinical information and transmit that information in an efficient manner will impact plan risk-adjusted capitation payments. CMS also conducts risk adjustment data validation (RADV) audits to ensure the accuracy of these payments. If an organization fails to properly accrue for anticipated risk adjustment payments or encounters issues in the RADV process, it may have to write down large receivables assets, leading to a hefty reduction in capital as well as financial distress.

Strong data collection and information exchange also enables advanced informatics and clinical analytics that are key elements to effective PHM. These capabilities allow for the accurate identification of high-risk individual patients and populations, the measurement of medical risk within a defined population, and predictive analytics to identify future opportunities for improving medical risk management.

Population Health Management

Focus on managing the health of the population through actionable information.

PHM employs information technology tools, as well as population data and financial incentives to improve quality and clinical outcomes while reducing aggregate healthcare costs. Elements of PHM include provider network development, risk stratification, clinical integration and care coordination, referral management, advanced informatics, and risk-based contracting. In addition, risk-based contracting with network partners helps to ensure the alignment of clinical priorities and provides financial incentives for high performers. Provider organizations that have the comfort to critically challenge “care” decisions excel. Again, evidence indicates that plans built around integrated delivery networks are more successful in using these tools and, consequently, have been noted as receiving higher Star ratings. In turn, integrated networks are more likely to receive the Star bonus, which can be used to enhance the plan’s financial performance, marketability, and enrollment.

Further, organizations effectively implementing PHM strategy elements are better at controlling plan costs. As medical costs comprise 80% to 85% of the premium dollar, a reduction in medical costs has a significant impact on PSMA plan premiums, membership levels, and overall plan financial performance.

Integrated Communication Strategy

Talk with your members … often.

An integrated communication strategy allows PSMA plans to identify new members, tailor communications to specific populations or individual healthcare needs, deliver relevant medical education content, provide access and opportunities to interact outside of the traditional care delivery setting, and build brand loyalty. As illustrated in the graphic above, an integrated communication strategy can also allow for more effective patient outreach and engagement with chronic disease management and prescription adherence programs.

In addition, a patient portal with comprehensive functionality can support outreach and engagement that allows organizations to:

- Distribute patient-specific health education and information resources.

- Provide clinical summaries.

- Improve access to services.

- Promote quality improvement through increased patient/family engagement.

An integrated strategy can also improve communication with providers to:

- Identify patients not currently engaged or participating in “optimized” disease or care management.

- Provide a plan for appropriate outreach.

- Ensure involvement from a care coordination team that would include other providers such as a health coach.

This type of systematic and continuous engagement and outreach is widely believed to impact enrollee satisfaction and provider performance. These benefits could also ultimately have a positive impact on a plan’s overall Star rating.

Visible Market Presence and Existing Patient Relationships

Establish a community presence.

Most consumers value personal interaction when making health plan purchasing decisions. Multiple consumer touch points reinforce brand loyalty, and the member enrollment, member services, and care delivery functions within a PSMA plan can all contribute to this end. Provider organizations’ direct access and community presence are critical elements in developing or enhancing brand loyalty. This area represents a strategic advantage for PSMA plans that is cost prohibitive for larger insurers to develop. In addition, PSMA plans have direct access to population data, which allows for more focused marketing campaigns and can enable providers to be informed advisers to their patients making MA plan choices.

MAXIMIZING THE MA OPPORTUNITY

MA represents a great opportunity for provider organizations to increase revenue, control the premium dollar, and market directly to their patient populations. However, provider organizations considering an MA plan, or those already sponsoring one, must be aware of and manage the significant financial, operational, and regulatory risks. PSMAs can optimize plan financial performance and mitigate these risks by investing in technology and operations infrastructure to support activities such as conducting clinical and claims data collection, developing strong PHM and medical risk management programs, adopting integrated communications strategies, and building upon the provider organization’s community presence and existing patient relationships.

Footnotes

1. T. Neuman, G. Casillas, and G. Jacobson, “Medicare Advantage and Traditional Medicare: Is the Balance Tipping?” Kaiser Family Foundation Issue Brief, October 2015.

2. HFMA citing CMS March 2014 data: R. Daly, Provider-Sponsored Plans Make up Half of New MA Plans, September 10, 2015.

3. Approximately 20% of 2016 MA plans are rated 3 Stars or lower according to Kaiser Family Foundation’s Medicare Advantage 2015 Data Spotlight.

4. McKinsey Center for U.S. Health System Reform, “Assessing the 2016 MA Stars ratings,” Intelligence Brief, October 2015.

5. T. Abbot, M. Durr, and M. Graf, “Winning on Stars: It Starts and Ends With Providers,” Oliver Wyman Point of View, October 2015.

6. An example of a provider-driven measure would be C17 – “Rheumatoid Arthritis Management” performance, while an example of a payer-driven measure would be C27 – “Members Choosing to Leave the Plan”.