Most community hospitals and health systems closely monitor their key clinical service lines, as they have long understood the value of these services to their overall portfolio. In particular, the revenue generated through advanced procedural and surgical care offsets losses from less-profitable services and facilitates long-term financial viability. However, service line advancement can come at a hefty price. Emerging technologies and value-based reimbursement incentives are driving hospitals to make investments that require significant capital and can potentially result in duplicative service offerings in the community. Additionally, smaller community hospitals may not have the patient volume to support implementation of a particular new service and yet cannot advance their program without it.

But it doesn’t have to be this way. What would the financial impact be to your hospital if you shared in the profit generated from cases that originated in your service area but were treated at a partner hospital? What value would your hospital bring to a community partner and, in turn, how could a structured collaboration enhance the scope of care being provided by your medical team?

While health systems are typically able to use their scale to achieve operational efficiencies beyond the reach of their smaller cohorts, hospitals of any size can benefit from clinical service line partnerships. These partnerships, also referred to as service line revenue mergers, enable historically competitive hospitals to partner and provide defined clinical services under a mutually beneficial arrangement.

Although the specifics of these arrangements vary to meet the parties’ shared objectives, the typical result is two or more organizations profiting financially while enhancing access to care and coordination of services. Tertiary and quaternary

providers benefit from a more coordinated referral pathway for advanced procedural and surgical care, while smaller community providers benefit from enhanced care coordination and rationalization across their facilities. If designed thoughtfully and carefully, this type of arrangement can ultimately result in more robust and profitable clinical service lines.

What Is a Service Line Revenue Merger?

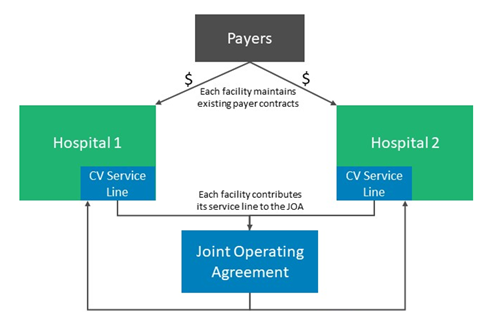

A service line revenue merger is typically established when two or more organizations enter a joint operating agreement (JOA) to manage and share in the performance of a clinical service line. An example of a service line revenue merger for a cardiovascular (CV) service line is illustrated in Exhibit 1. In this example, two community hospitals create a financially integrated partnership for their combined CV service lines. Features of this arrangement are detailed below:

- Ownership: The value of each hospital’s contribution to the JOA determines its ownership of the JOA. For example, if one hospital’s service line is valued at $7 million, and the other’s is valued at $3 million, the JOA ownership would be shared 70 percent and 30 percent, respectively.

- Governance and Management: The JOA board has authority over the CV service line, including strategic planning, development of operating and capital budgets, determination of new service offerings or locations, etc.

- Scope of services: The definition of CV services may vary depending on the service offerings of each organization, but the parties agree on which services should be included in the partnership and how those services should be defined.

- Operations: Each hospital typically maintains its own operations.

- Clinical integration: While the JOA facilitates increased clinical coordination (e.g., care pathways and transfer protocols), the organizations continue to bill for services under their own licenses, payer contracts, and provider numbers.

- Funds Flow: The income or loss from each hospital’s service line is combined and allocated based on the parties’ respective ownership percentages.

How Do Communities Benefit?

Service line revenue mergers are designed to enhance access to services by bringing them closer to patients’ homes, provide greater care coordination for advanced procedural care, and optimize the provision of services in a site-neutral fashion that mitigates unnecessary duplication. Benefits include the following:

- Enhanced access: Hospitals are able to offer a broader spectrum of care to patients seeking services in their collective service area, resulting in improved service line performance and patient access.

- Expanded Services: Shared investment in a joint service line potentially allows hospital partners to expand the level of services they offer together.

- Coordinated care: Increased collaboration facilitates the development of shared clinical protocols, care pathways, provider education/training, and a more seamless patient care experience.

- Redundancy avoidance: Clinical and financial integration mitigates the need for organizations to unnecessarily offer duplicative services and ensures that patient care is provided appropriately across the partnering facilities.

- Financial performance: Hospital partners frequently benefit from a more cohesive referral pathway and at least some degree of economies of scale (e.g., group purchasing).

How Are Service Line Revenue Mergers Developed?

The process to develop a service line revenue merger involves defining the partnership opportunity, confirming the scope of services to be included, preparing a business plan for the proposed partnership, and defining the specific terms of the arrangement. Experienced legal counsel should be engaged early to help guide the process.

- Defining the opportunity: An assessment to define the benefits of an arrangement between the parties should include an evaluation of market data to understand the competitive forces and growth opportunities. In addition, operational and financial information related to the service line at each organization should be assessed to determine strengths and weaknesses and to evaluate opportunities to improve overall patient care delivery.

- Confirming the scope of services: While the parties may agree conceptually on the scope of services to be included in the partnership, it is important to ensure acommon understanding of 1) what can be easily monitored by both parties and 2) what each organization is contributing to the arrangement.

- Planning the business: A business plan for the JOA should be collaboratively developed to appropriately plan for changes to the joint care delivery model and to project its financial performance. The business plan should outline key elements, such as the following:

-

- Partnership vision and goals

- Business development opportunities

- Financial projections and capital requirements

- Defining the terms of the arrangement: Concurrent with business plandevelopment, the parties should discuss the JOA terms. Ideally, a facilitator and legal counsel would meet with key stakeholders, including executives and physician representatives from each organization, to evaluate possible JOA contractual provisions related to the following terms:

-

- Buy-in/asset contribution and equity ownership

- Management and governance

- Performance monitoring

- Funds flow and distribution formula

- Term, termination, and dissolution details

- Noncompetition and nonsolicitation clauses

While there are numerous benefits associated with a service line revenue merger, its success ultimately requires close collaboration between the parties and a clearly defined scope of services. Hospital boards should consider the relative value of a JOA in light of community need for access to local and advanced specialty care. Careful consideration of an arrangement’s terms and its ongoing management will ensure the collective goals of the parties are achieved and the resulting partnership is financially beneficial.

Are you looking to optimize the value of your clinical service line partnerships?

Contact our experts today.

This article was originally featured in the Quarterly Governance Institute April 2021 Newsletter.